From Paper Piles to Perfect Payments: My Journey with ERP Vendor Payment Automation

Remember those days? The stacks of invoices, the endless email chains for approvals, the frantic calls about late payments, and the sheer dread of month-end closing. For years, that was my reality in the finance department. I used to joke that my office was powered by coffee, spreadsheets, and a perpetually ringing phone. But then, something truly transformative happened. We embraced ERP Vendor Payment Automation, and it wasn’t just a tech upgrade; it was a revelation that changed everything.

This isn’t just a technical article about software; it’s my personal story, a journey from chaos to calm, from manual drudgery to digital mastery. If you’re a beginner curious about how technology can truly streamline your business, or if you’re still wrestling with the old ways, pull up a chair. I promise, by the end of this, you’ll see why this seemingly complex solution is actually the simplest path to peace of mind.

The Old Way: A Symphony of Stress and Spreadsheets

Let me paint you a picture of my life before. Imagine a typical Tuesday morning. My desk would be a fortress of paper: supplier invoices, expense reports, payment requests. Each piece of paper represented a vendor expecting payment, a relationship to maintain, and a potential late fee if I wasn’t vigilant.

Our process was, to put it mildly, antiquated.

- Invoice Receipt: Invoices would arrive via email, post, or even fax (yes, fax!). Someone had to manually open, sort, and log each one.

- Data Entry: Every single line item, every amount, every due date had to be typed into our accounting software. This was where the first set of human errors inevitably crept in. A typo here, a missed digit there – small mistakes with potentially large consequences.

- Matching & Approval: Then came the detective work. We had to match each invoice to a purchase order (PO) and a goods receipt note (GRN). If there was a discrepancy, the chase began: emails to procurement, calls to warehouse, a whole lot of "where is this invoice?" This process could take days, sometimes weeks, especially if key approvers were on vacation or simply swamped.

- Payment Processing: Once approved (finally!), we’d manually prepare payment batches. This involved logging into multiple bank portals, setting up individual payments, or generating physical checks. Each step was a bottleneck, a point of potential fraud, and a drain on our precious time.

- Reconciliation: And then, the grand finale – reconciling bank statements with our records. Spotting discrepancies was like finding a needle in a haystack, leading to more investigative work and delayed month-end closings.

It wasn’t just inefficient; it was demoralizing. My team felt like glorified data entry clerks and paper pushers. We were constantly firefighting, always reacting, never truly strategizing or adding real value to the company. Our vendor relationships suffered too; late payments, even if accidental, eroded trust.

The "Aha!" Moment: There Has to Be a Better Way

The breaking point came during a particularly grueling month-end. We missed a critical vendor payment, incurring a hefty late fee and almost straining a crucial supplier relationship. That’s when I knew we couldn’t go on like this. We already had an Enterprise Resource Planning (ERP) system in place for other functions like inventory and sales, but we weren’t fully leveraging its power for finance.

I started researching. "How can an ERP help with payments?" "Automated Accounts Payable." "Streamlining vendor payments." The keywords led me down a rabbit hole, and that’s where I first truly understood the potential of ERP Vendor Payment Automation. It wasn’t just about making things a little bit faster; it was about fundamentally transforming our entire Accounts Payable (AP) process.

What Exactly is ERP Vendor Payment Automation? (For Beginners)

Let’s break it down in simple terms. Imagine your ERP system as the central brain of your business. It already knows about your sales, your inventory, your customers. ERP Vendor Payment Automation essentially teaches that brain to also expertly manage all your outgoing payments to suppliers.

Think of it as having a super-efficient, tireless assistant who:

- Intelligently Receives Invoices: Instead of manual handling, invoices (digital or scanned physical ones) are automatically captured and read using technologies like Optical Character Recognition (OCR). This means the system extracts all the important information – vendor name, amount, due date, invoice number – without anyone typing it in.

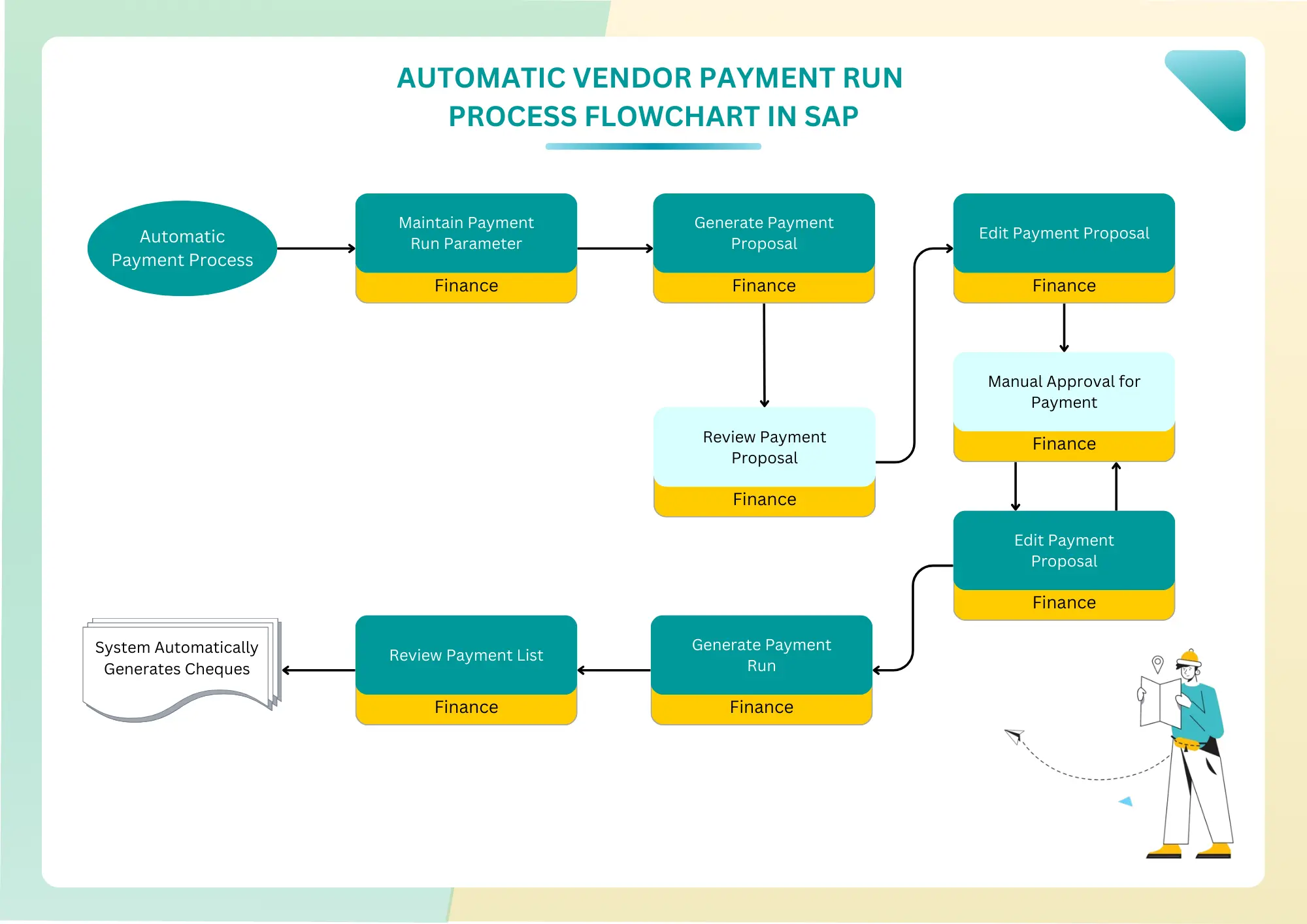

- Automatically Matches & Verifies: The system then automatically compares this invoice data against your purchase orders (POs) and goods receipt notes (GRNs) already stored in the ERP. If everything matches perfectly (a "2-way" or "3-way match"), it moves on. If there’s a discrepancy, it flags it for human review, directing it to the right person.

- Digitally Routes for Approval: No more chasing paper! The ERP system automatically sends the invoice through a predefined approval workflow. Approvers receive notifications, can review the invoice on their computer or even phone, and approve or reject it with a click. The entire audit trail is meticulously recorded.

- Executes Payments: Once approved, the ERP system integrates directly with your bank or payment service provider. It can initiate electronic payments (ACH, wire transfers, virtual cards) based on the due date, ensuring payments are made on time, every time, without manual intervention.

- Automatically Reconciles: After payment, the system automatically marks the invoice as paid and can even reconcile with bank statements, providing real-time visibility into your cash flow.

In essence, it takes the repetitive, error-prone, and time-consuming manual steps out of the vendor payment process and replaces them with a streamlined, digital, and intelligent workflow within your existing ERP environment.