Let me tell you a story. It’s a story many business owners and finance professionals will recognize – a tale of paper mountains, frantic searches, missed deadlines, and the quiet dread that accompanied the arrival of every new invoice. For years, my company, much like countless others, wrestled with a manual invoice approval process that felt less like a system and more like a never-ending game of hide-and-seek.

But then, something shifted. We embraced a hero, a silent champion that transformed our financial operations from chaos to clarity: the ERP Invoice Approval Workflow. And believe me, it was a game-changer. If you’re a beginner trying to understand what this seemingly complex term means and why it’s become indispensable, pull up a chair. I’ll tell you all about it, not as a textbook, but as a journey I personally experienced.

The "Good Old Days" (Spoiler: They Weren’t!)

Before we dive into the solution, let’s revisit the problem. Imagine this:

- Piles of Paper: Invoices arriving via snail mail, email attachments, faxes (yes, faxes!). Each one printed, perhaps stamped, and then… what?

- The Signature Chase: An invoice for office supplies needed approval from the office manager. A marketing campaign invoice needed the marketing director’s sign-off. A major vendor bill? That went straight to the CEO. The problem? These people were rarely at their desks, often traveling, or simply buried under their own piles.

- The "Lost in Transit" Phenomenon: An invoice would sit on someone’s desk for days, sometimes weeks, buried under other documents or simply forgotten. We’d get calls from vendors asking about late payments, only to discover the invoice was still waiting for a signature.

- Manual Data Entry & Errors: Once approved (finally!), someone in accounts payable would manually enter all the details into our accounting system. This was ripe for typos, duplicate entries, and misclassifications.

- Audit Nightmares: Come audit season, trying to track the approval chain for a specific invoice was like digging for treasure without a map. "Who approved this? When? Where’s the proof?"

This wasn’t just inconvenient; it was costly. We missed early payment discounts, incurred late fees, wasted countless hours, and lived with the constant anxiety of potential fraud or errors. Our financial health felt perpetually precarious.

Enter the Hero: What Exactly is an ERP Invoice Approval Workflow?

It sounds technical, doesn’t it? But at its heart, an ERP Invoice Approval Workflow is elegantly simple. Think of it as a digital traffic controller for your invoices.

ERP stands for Enterprise Resource Planning. It’s a comprehensive software system that integrates various functions of a business – finance, HR, inventory, sales, and more – into one unified platform.

An Invoice Approval Workflow within an ERP system is a pre-defined, automated sequence of steps that an invoice must go through from the moment it’s received until it’s ready for payment. It ensures that every invoice gets the right approvals from the right people, at the right time, all within the digital confines of your ERP system.

Instead of physically walking an invoice around, the system does it electronically. It’s like having a super-efficient digital assistant who knows exactly who needs to see what, when, and how.

My "Aha!" Moment: Why We Needed This Transformation

Our decision to implement an ERP system, and specifically its invoice approval workflow, wasn’t just about catching up with technology; it was about survival and growth. Here’s what convinced us:

- Speed and Efficiency: No more physical chasing! Invoices are routed instantly. Approvers get notifications, can review, and approve with a click from anywhere, on any device. What used to take days now takes minutes or hours.

- Accuracy and Error Reduction: Automated data extraction (often using OCR – Optical Character Recognition) reduces manual entry errors. The system can even automatically match invoices against purchase orders (POs) and goods receipts, flagging discrepancies before they become problems.

- Cost Savings: Beyond eliminating late fees and capturing early payment discounts, we saved on labor costs. Our accounts payable team could focus on more strategic tasks instead of administrative grunt work. Less paper, less printing, less storage.

- Unprecedented Visibility and Control: At any given moment, I could see exactly where every invoice was in the approval process. No more wondering if it was lost. We knew who had it, how long they’d had it, and what action was pending. This visibility was like shining a spotlight into a previously dark room.

- Robust Compliance and Audit Trails: Every action – reception, approval, rejection, comments – is automatically logged and time-stamped within the ERP system. When audit season came, we could pull up a complete, immutable history for any invoice with just a few clicks. This level of transparency is invaluable.

- Scalability: As our company grew, the number of invoices naturally increased. A manual system would have buckled under the pressure. The ERP workflow scaled effortlessly, handling more volume without needing to hire more people just to shuffle paper.

A Peek Behind the Digital Curtain: How Our ERP Invoice Approval Workflow Works (The Step-by-Step)

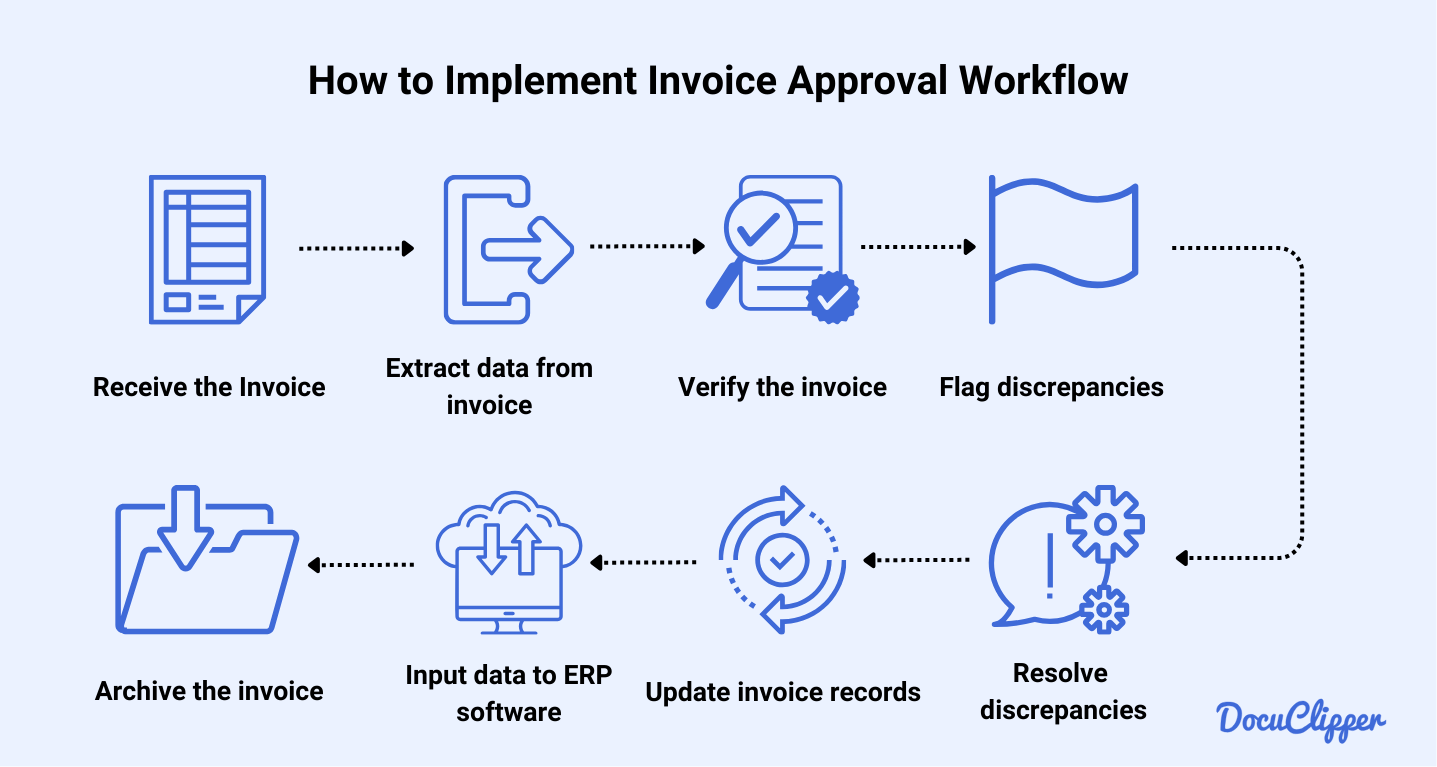

So, how does this digital magic actually happen? Here’s a simplified breakdown of the steps we experience daily: