My Journey to Uncover Hidden Riches: How ERP Inventory Cost Analysis Changed Everything

You know that feeling, right? The one where you’re working tirelessly, seeing sales numbers climb, but when you look at the bottom line, it’s just… meh. Profits aren’t what they should be. For years, I felt like I was running a business with a slow leak in its financial tires. My product was good, my team was dedicated, but something was constantly draining our resources. And for the longest time, I blamed everything but the real culprit: my inventory.

Oh, inventory! The lifeblood of any product-based business. We needed it to fulfill orders, to keep customers happy, but it also felt like a giant, hungry monster in the corner, constantly demanding more space, more attention, and more cash. I used to think managing inventory was just about knowing what we had, where it was, and when to reorder. Boy, was I wrong.

My "aha!" moment came when I finally decided to stop guessing and start analyzing. That’s when I stumbled upon the magic words: ERP Inventory Cost Analysis. It sounds like a mouthful, doesn’t it? A bit corporate, maybe even intimidating. But trust me, for a small to medium business owner like me, it became the flashlight that helped me navigate the dark corners of my warehouse and, ultimately, my balance sheet.

Let me tell you my story, and by the end of it, I hope you’ll see why understanding this concept isn’t just for big corporations – it’s for anyone who wants to turn their inventory from a liability into a genuine asset.

The Fog Before the Clarity: My Early Inventory Nightmares

Before ERP, my inventory management was a chaotic blend of spreadsheets, gut feelings, and hurried phone calls to suppliers. We had a system, yes, but it was manual, prone to errors, and incredibly inefficient.

I remember one particularly stressful quarter. We had a huge rush order come in. Great news, right? Except we didn’t have enough of a key component. Panic ensued. We paid extra for expedited shipping, disrupted our production schedule, and nearly missed our deadline. On the flip side, I also had a corner of the warehouse dedicated to "just in case" items that had been sitting there for months, gathering dust, slowly becoming obsolete.

I knew these things were costing me money – the expedited shipping, the lost sales from stockouts, the capital tied up in dormant stock. But I couldn’t quantify it. It was a vague, unsettling feeling. I couldn’t put a finger on exactly how much these inventory problems were eating into my profits. It was like trying to patch a leaky boat when you couldn’t even see the holes.

This is where the concept of inventory cost management truly comes into play. It’s not just about counting boxes; it’s about understanding the financial implications of every single item you hold.

The Turning Point: Embracing ERP, Not Just for Tracking

Eventually, the pain became too great. My business was growing, but so were the inventory headaches. I realized I needed a more robust solution. That’s when I started looking into Enterprise Resource Planning (ERP) systems.

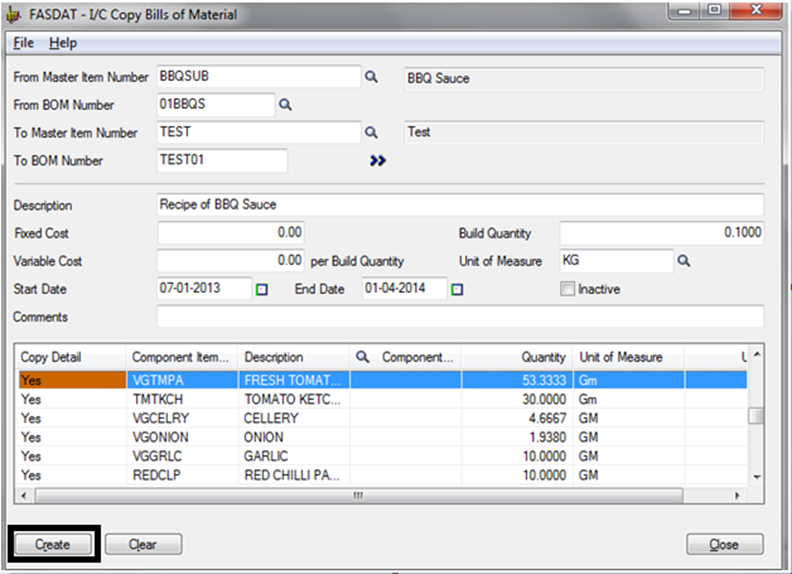

Initially, I thought ERP was just a fancy way to track stock, automate orders, and manage my customer data. And it is, to some extent. But the real game-changer for me wasn’t just tracking inventory; it was using the ERP to analyze the costs associated with it.

It’s like getting a high-tech dashboard for your car, not just to see your speed, but to understand your fuel efficiency, engine health, and even predict maintenance needs. An ERP system, when properly implemented for inventory, gives you that level of insight.

Deconstructing the Beast: What Exactly is ERP Inventory Cost Analysis?

At its core, ERP Inventory Cost Analysis is the process of systematically identifying, quantifying, and evaluating all the costs associated with acquiring, holding, and managing your inventory. And an ERP system is the perfect tool for this because it brings all the relevant data – from purchasing to warehousing to sales – into one centralized place.

Before I explain how ERP helps, let’s break down the "beast" of inventory costs into its three main categories. Understanding these was my first big step towards financial clarity:

1. Carrying Costs (The Silent Profit Drainer)

These are the costs you incur for simply holding inventory. They’re often invisible because they don’t involve a direct invoice every month, but they are absolutely real and can be significant. Think of them as the rent you pay for your inventory to exist.

- Storage Costs: This includes warehouse rent or depreciation, utilities (electricity for lighting, heating, cooling), maintenance, and even property taxes. My ERP showed me exactly how much space each product took up and the associated cost.

- Insurance Costs: Protecting your goods from theft, damage, or natural disasters.

- Obsolescence and Shrinkage: This was a huge one for me. Goods that become outdated, damaged, or simply disappear (shrinkage) are a direct loss. My ERP’s detailed tracking and reporting capabilities highlighted slow-moving items long before they became completely unsellable. It was like a warning light for potential losses.

- Capital Costs: The money tied up in inventory could be used elsewhere – invested, used to pay down debt, or fund other business growth initiatives. My ERP helped me see the true opportunity cost of having too much capital sitting on shelves.

- Handling Costs: The labor and equipment involved in moving, stacking, and retrieving items within the warehouse.

How ERP Helps: My ERP system automatically collected data on warehouse space utilization, inventory age, and historical movement. This allowed me to calculate a much more accurate carrying cost percentage for each item and identify products that were costing me more to hold than they were worth.

2. Ordering Costs (The Transactional Tally)

These are the expenses associated with placing and receiving an order. They’re not just the cost of the goods themselves, but everything around the order.