I remember those days vividly, a cloud of dread hanging over our finance department long before quarter-end, let alone year-end. My name is Alex, and I’ve spent the better part of two decades navigating the labyrinthine world of business finance. For a significant portion of that time, tax calculation felt less like a structured process and more like an elaborate, high-stakes guessing game, played with spreadsheets, endless tabs open in a browser for various tax authority websites, and a healthy dose of crossed fingers. Every sales invoice, every purchase order, every payroll run felt like another potential landmine.

We were a growing company, expanding our reach not just across state lines but into international waters. What started as a relatively straightforward sales tax calculation in our home state quickly became a monstrous beast. Suddenly, we weren’t just dealing with a single rate, but a patchwork quilt of local, state, and even county-specific taxes. Then came the complexities of VAT for our European clients, the intricacies of use tax for internal purchases, and the ever-present headache of corporate income tax provisions. And let’s not even get started on payroll taxes, which seemed to change with the wind. The finance team, bless their diligent hearts, were practically living in the office during peak periods. I’d walk by their desks late at night and see them hunched over screens, eyes glazed, surrounded by printouts, highlighters, and empty coffee cups. The atmosphere was always tense, punctuated by the frantic clicking of keyboards and the occasional groan of frustration.

Errors were, sadly, an inevitable part of the process. A misplaced decimal, a forgotten exemption, an outdated tax rate – each tiny mistake had the potential to snowball into significant penalties during an audit. I recall one particularly harrowing audit where a seemingly minor miscalculation on sales tax for a specific product category across several states led to weeks of back-and-forth with auditors, thousands of dollars in fines, and a massive drain on our team’s morale and productivity. It wasn’t just the money; it was the sheer mental anguish, the feeling of vulnerability. We were trying our best, working tirelessly, but the sheer volume and complexity of tax regulations were simply overwhelming for a manual system. Our existing Enterprise Resource Planning (ERP) system was fantastic for managing inventory, sales, and general ledger entries, but when it came to tax, it was mostly a glorified calculator that needed constant, manual feeding of rates and rules. It felt like we were using a high-performance race car but still insisting on pushing it by hand for the last mile.

The turning point came during one of our strategic planning meetings. We were discussing scaling the business, eyeing new markets, and the finance director, a seasoned veteran named Maria, looked utterly exhausted. She presented a slide titled "Tax Compliance: Our Biggest Bottleneck." The numbers were stark: hundreds of hours spent monthly on manual calculations and reconciliation, significant risk exposure due to potential errors, and a clear limitation on our ability to expand quickly without exponentially increasing our finance headcount. It was clear we needed a different approach. We needed to automate.

That’s when we started seriously looking into ERP tax calculation automation. The idea was simple, yet revolutionary: integrate a system directly into our ERP that could handle all the tax complexities automatically, in real-time, without human intervention for every single transaction. It sounded almost too good to be true. My initial skepticism was high. Could a piece of software truly understand the nuances of sales tax nexus, VAT reverse charges, or the latest changes in payroll tax withholding tables? Would it be able to differentiate between taxable and non-taxable items, handle exemptions, and apply the correct rates based on origin and destination?

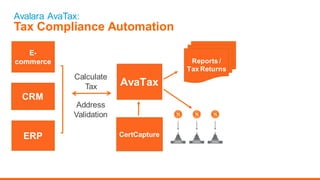

What I learned, and what truly transformed our operations, was that these specialized tax automation solutions, when properly integrated with an ERP, are designed precisely for these challenges. They act as an intelligent layer, a kind of digital tax expert, sitting right inside your existing ERP system. When a sales order is entered, or an invoice is generated, the ERP sends the relevant transaction data – like the product code, the customer’s address, the shipping destination, and the sales amount – to the tax automation engine. This engine, pre-loaded with an enormous, constantly updated database of tax rules and rates for every relevant jurisdiction, instantly calculates the correct tax amount. It considers everything: the type of product, whether the customer is tax-exempt, the specific location’s tax holidays, and even the most obscure local surcharges. Then, it sends that calculated tax amount back to the ERP, where it’s automatically applied to the invoice and posted to the correct general ledger accounts.

The impact was immediate and profound. The first thing we noticed was the sheer accuracy. Suddenly, errors virtually disappeared. The system didn’t get tired, it didn’t misread a spreadsheet cell, and it didn’t forget to check for the latest rate update. Because the tax database was maintained by experts and updated continuously, we no longer had to manually monitor thousands of tax jurisdictions for changes. If a state changed its sales tax rate, or a new local tax was introduced, our system automatically incorporated it, often before we even knew about it. This dramatically reduced our audit risk, giving me a level of peace of mind I hadn’t experienced in years. The auditors still came, of course, but now, instead of dread, there was a quiet confidence. We could easily pull reports that showed every calculation, every rule applied, every exemption justified. It was all transparent and verifiable.

Then there was the incredible boost in efficiency. What used to take hours or even days of manual effort – calculating taxes on invoices, reconciling tax liabilities, preparing tax returns – was now handled in seconds. Our finance team, once bogged down in repetitive, tedious tasks, could now dedicate their valuable time to more strategic activities. They could analyze financial data, forecast trends, and focus on optimizing our financial health, rather than just keeping the wheels from falling off. Month-end and quarter-end closings became significantly smoother. No more late nights, no more frantic double-checking. The tax numbers were simply there, correct and ready. This wasn’t just about saving time; it was about elevating the quality of work and the job satisfaction of our team. The atmosphere in the finance department shifted from one of stress to one of focused productivity.

Compliance became less of a burden and more of a given. As we expanded internationally, dealing with various VAT regimes, goods and services taxes (GST), and other global tax requirements became much more manageable. The automation system was designed to handle these complexities, applying the correct rules based on the destination country, the nature of the goods or services, and the customer’s status. This capability was crucial for our growth strategy, allowing us to enter new markets with confidence, knowing our tax obligations were being met accurately and efficiently. We no longer had to hire local tax consultants for every new country we entered, significantly reducing our operational costs.

The visibility and reporting capabilities also improved dramatically. With every transaction’s tax details automatically captured and categorized, generating detailed tax reports became effortless. We could slice and dice data in countless ways: by product, by customer, by jurisdiction, by tax type. This not only made audit responses simpler but also provided invaluable insights for business planning. We could see exactly where our tax liabilities were accumulating, identify trends, and even proactively manage our tax exposure. The ability to pull accurate, comprehensive tax data at a moment’s notice was a game-changer.

Cost savings weren’t just about avoiding penalties. They were also about reducing the amount of highly skilled, expensive labor we were dedicating to manual tax calculations. Instead of needing multiple finance professionals to manage tax compliance across various regions, a smaller, more strategically focused team could oversee the automated system. This allowed us to scale our operations without a proportional increase in our administrative overhead. When we opened new warehouses or started selling in new states, the tax system simply adapted, integrating the new locations and their respective tax rules seamlessly.

Of course, the journey wasn’t without its initial bumps. Implementing an ERP tax calculation automation system requires careful planning and integration. It meant reviewing our existing product categories, ensuring our customer data was clean and accurate, and mapping our general ledger accounts correctly. We had to work closely with our IT team and the solution provider to ensure a smooth transition. There was a learning curve for the finance team to understand how the new system worked, how to interpret its reports, and how to handle exceptions (which, thankfully, became much rarer). But the investment in time and effort upfront paid dividends almost immediately. The initial training and configuration phase felt like a small hill to climb, but the view from the top was breathtaking.

One of the most powerful changes I observed was the shift in our company culture regarding tax. It moved from being a source of fear and stress to a managed, controlled process. My team members were no longer just number crunchers; they were strategic financial partners, equipped with accurate data and the time to analyze it. They could advise sales on the tax implications of new product lines or expansion into new territories, rather than just reacting to them after the fact.

For any business, especially those grappling with growth, multi-jurisdictional sales, or just the sheer weight of ever-changing tax regulations, considering ERP tax calculation automation is no longer a luxury; it’s a necessity. Whether you’re dealing with complex sales tax across 50 states and thousands of local jurisdictions, or trying to navigate the intricacies of VAT for international trade, or simply want to ensure your payroll tax withholdings are always spot-on, an automated solution can free you from the shackles of manual processing. It brings accuracy, efficiency, compliance, and peace of mind. It allows you to focus on what you do best: growing your business, innovating, and serving your customers, without the constant worry of an impending tax audit.

Looking back at those stressful nights, the frantic searches, and the nagging fear of error, I often marvel at how far we’ve come. The finance department is now a hub of calm efficiency, even during peak periods. The glow of monitors still shines late sometimes, but now it’s from strategic planning, not desperate number-crunching. Our ERP, once a powerful but incomplete tool, is now truly an integrated powerhouse, driving our business forward with precision, especially when it comes to the often-overlooked but critically important world of tax. It was a silent revolution, but its impact echoed throughout every corner of our organization.