I remember the day it truly hit me. Our company, a thriving mid-sized business, had just completed a massive overhaul, replacing our patchwork of old systems with a shiny, new Enterprise Resource Planning (ERP) suite. It was a huge investment, a project that had taken months of planning, implementation, and no small amount of stress for everyone involved. We’d chosen our ERP vendor after what felt like an eternity of demos, proposals, and reference calls, convinced we’d picked the perfect partner. Yet, a few months post-go-live, something felt off.

User adoption wasn’t as high as we’d hoped. Our finance team grumbled about certain processes being clunkier than before. Sales reps found some features less intuitive. The IT department, bless their hearts, were constantly putting out small fires. My initial thought was, "Well, that’s just how big changes go, right? There’s always a learning curve." But as the weeks turned into months, I started to wonder if it was more than just growing pains. It felt like we were missing something fundamental, a true understanding of what was working and, more importantly, what wasn’t, directly from the people using the system every single day.

This feeling led me down a rabbit hole, a journey into what I now passionately call ERP Vendor Feedback Analytics. It’s not just about collecting complaints or praise; it’s about systematically understanding the entire experience with our ERP system and its vendor, turning those scattered opinions into actionable insights. Think of it like this: when you buy a new car, you might read reviews, but what truly tells you if it’s right for you is driving it, living with it, and seeing how it performs over time. And if something goes wrong, you want to know if the dealership is there for you. Our ERP system was the engine of our business, and we needed to know exactly how that engine, and the team maintaining it, was performing.

At its core, ERP vendor feedback analytics is the process of gathering, analyzing, and acting upon the opinions, experiences, and suggestions of everyone who interacts with your ERP system and the vendor who supplies and supports it. It spans from the end-users punching in data to the IT administrators troubleshooting issues, from the project managers overseeing implementations to the executives reviewing strategic reports. It’s a continuous conversation, not a one-time survey. Before I truly grasped this, our feedback process was pretty informal: a few ad-hoc meetings, some water-cooler complaints, and the occasional email expressing frustration. That approach, I quickly learned, was like trying to navigate a dense fog with only a flashlight.

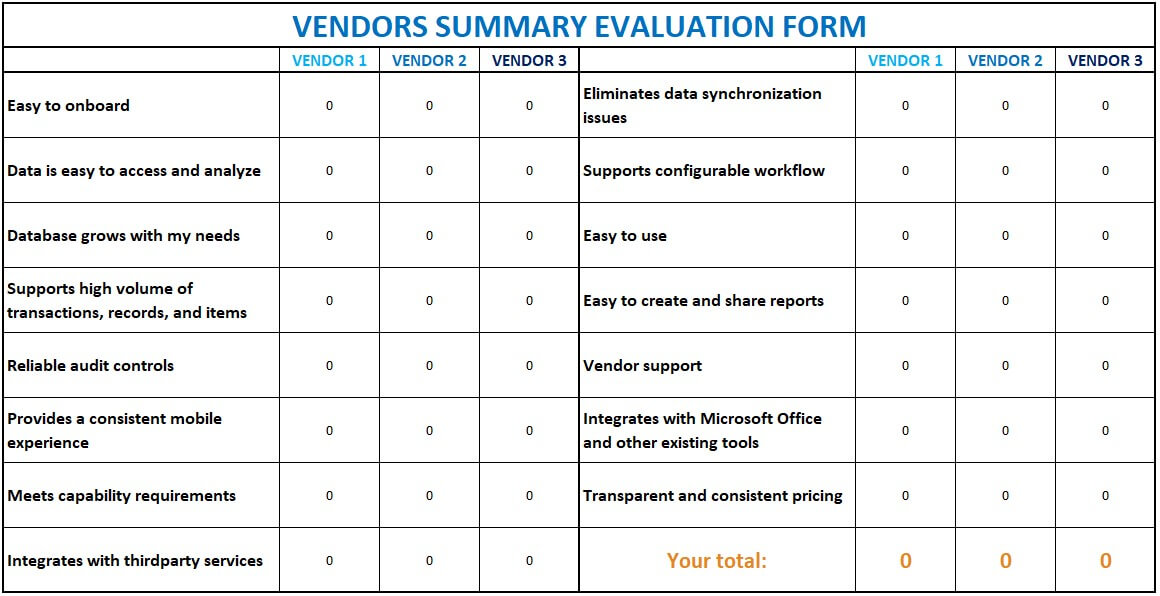

The first step, for me, was realizing we needed a more structured way to collect information. We started simple. We designed a straightforward survey, not too long, focusing on key areas. We asked about the ease of use of different modules, the responsiveness and helpfulness of the vendor’s support team, the quality of training provided, and whether the system was actually meeting the business needs it was designed for. We also included open-ended questions, because sometimes the most valuable insights come from someone explaining their frustrations or suggesting an improvement in their own words.

But surveys were just the beginning. I also looked at our internal support tickets. If a specific type of issue kept popping up, or if resolution times for certain problems were consistently long, that was a huge red flag pointing to a potential vendor-side issue or a training gap. We started categorizing these tickets not just by problem type, but also by the ERP module they related to and even the vendor representative who handled them, if applicable. This helped us see patterns we’d never noticed before. For example, we discovered a disproportionate number of issues related to our inventory management module, suggesting either a problem with the software itself or how our team was trained to use it.

Another valuable source of feedback came from our regular check-in meetings with department heads. Instead of just talking about project progress, we started dedicating a portion of these meetings to direct questions about the ERP system: "What’s one thing that’s really working for your team?" and "What’s one persistent challenge you’re facing?" This wasn’t about finger-pointing; it was about opening up a safe space for honest dialogue. Sometimes, the quietest people had the most profound insights. We also made it a point to listen to the "grapevine" – the informal conversations and comments, because often, those were indicators of underlying sentiment.

Once we had all this data – survey responses, support ticket trends, meeting notes, anecdotal observations – the real work of "analytics" began. It wasn’t about fancy algorithms for us initially, but about systematic organization and interpretation. We started by simply tallying scores from our surveys. How did people rate support? How did they rate ease of use? We looked at the average scores, but more importantly, we looked at the outliers – the really low scores and the really high ones – and tried to understand why.

The open-ended comments were a treasure trove. I remember spending hours reading through them, highlighting recurring themes. If three different people from three different departments mentioned "slow loading times" or "difficulty generating custom reports," that wasn’t just individual grumbling; that was a systemic issue. We used simple tools, even just a spreadsheet, to categorize these qualitative comments. We grouped them by "vendor support," "system performance," "feature gaps," "training needs," and so on. This helped us quantify the qualitative, giving us a clearer picture of the most pressing concerns.

One of the most eye-opening aspects of this analysis was recognizing sentiment. Not in a complex AI way, but just by reading the tone of the comments. Were people expressing frustration, confusion, appreciation, or indifference? If a lot of comments were laced with frustration, even if they were about different things, it signaled an overall negative experience that needed addressing, possibly at a deeper cultural level regarding the vendor relationship.

This analytical process allowed us to move beyond individual complaints and identify overarching trends. We could see, for instance, that while our sales team generally liked the CRM capabilities, they were struggling with the integration to the finance module. Meanwhile, the finance team was happy with their core processes but felt the vendor’s technical support was slow. These distinct patterns helped us pinpoint specific areas for improvement, rather than just vaguely asking the vendor to "do better."

The most crucial part of this entire endeavor, though, wasn’t just gathering and analyzing; it was acting on the feedback. What good is knowing if you don’t do anything about it? Armed with our categorized data, complete with specific examples and trends, we scheduled a dedicated meeting with our ERP vendor. This wasn’t a "gripe session." This was a data-driven discussion.

I recall presenting our findings: "Our survey shows that 60% of users find the report generation process difficult. We’ve also logged X number of support tickets related to this in the last quarter. Here are some direct quotes from our users about their frustrations." This approach changed the dynamic of our relationship with the vendor. Instead of subjective complaints, we offered objective data. It was harder for them to dismiss. It also demonstrated that we were serious about making the partnership work, and that we were investing our own time to identify problems collaboratively.

The vendor, to their credit, responded positively. With concrete evidence, they could see the specific pain points. We worked together to address them: organizing targeted training sessions for report generation, assigning a dedicated support specialist for the finance module, and even putting certain feature enhancements on their development roadmap. This wasn’t an overnight fix, but it marked a significant turning point. Our internal teams felt heard, the vendor felt engaged in a productive dialogue, and slowly but surely, user satisfaction began to creep upwards.

The benefits of this deep dive into ERP vendor feedback analytics were profound and far-reaching. Firstly, it dramatically improved our relationship with the vendor. We moved from a transactional client-vendor dynamic to a more collaborative partnership. When you show a vendor exactly where the issues lie with data, they are much more likely to listen and respond proactively.

Secondly, it led to tangible improvements in our ERP system’s performance and usability. By addressing specific pain points, we saw an increase in user adoption and efficiency. Our finance team eventually found their rhythm, and sales reps could integrate data more seamlessly. This meant fewer errors, faster processes, and ultimately, a better return on our massive ERP investment.

Thirdly, it empowered our internal teams. They felt their voices mattered. Knowing that their feedback was being systematically collected, analyzed, and acted upon fostered a sense of ownership and engagement. It turned passive users into active participants in the system’s ongoing improvement.

Moreover, it gave us foresight. By regularly analyzing feedback, we could spot emerging issues before they escalated into major problems. We could be proactive, not reactive. If a new module was rolled out and we started seeing a slight dip in related satisfaction scores, we could intervene early with additional training or vendor consultation, rather than waiting for a full-blown crisis.

Of course, this journey wasn’t without its challenges. Getting everyone to consistently provide feedback took effort. Some people were naturally resistant to surveys or felt their comments wouldn’t make a difference. We had to repeatedly communicate the "why" – explaining how their input directly contributed to a better system for everyone. We also had to manage expectations; not every suggestion could be implemented, and some changes took time. It was a marathon, not a sprint. And sometimes, even with compelling data, a vendor might be slow to react, requiring persistence and clear escalation paths.

But the biggest lesson I learned was that ERP vendor feedback analytics isn’t a one-time project; it’s an ongoing organizational muscle that needs to be regularly exercised. Our business evolves, our needs change, the ERP system itself gets updates, and the vendor’s team might shift. Continuous feedback loops ensure that our ERP system remains aligned with our strategic goals and that our relationship with the vendor stays strong and productive. It’s about creating a culture where feedback is valued, understood, and used as a compass to guide our technological future.

Today, our ERP system runs smoother, our teams are more proficient, and our relationship with the vendor is built on trust and mutual understanding. It all started with that nagging feeling that we were missing something, and the decision to systematically listen to the voices of those who knew the system best: its users. For anyone out there grappling with an ERP implementation or ongoing vendor relationship, I can’t emphasize enough the transformative power of truly understanding and acting upon ERP vendor feedback. It’s not just data; it’s the heartbeat of your business system.