I remember a time when budget season felt less like strategic planning and more like a frantic archaeological dig. Every year, it was the same story: a mountain of spreadsheets, endless email threads trying to track down numbers, and a sinking feeling that by the time we finalized anything, the data was already outdated. My name is Alex, and for years, I wrestled with our company’s finances, feeling like I was always a step behind, reacting to problems instead of anticipating them. Our business was growing, which was fantastic, but with growth came complexity, and our old ways of managing money just weren’t cutting it anymore.

We had an ERP system, a big, powerful beast of software that handled our sales, inventory, and even some HR functions. But when it came to budgets, it felt like a separate, forgotten island. We’d pull reports from the ERP, dump them into Excel, and then begin the arduous task of comparing actual spending against our meticulously planned figures. The process was slow, prone to human error, and frankly, soul-crushing. Decisions about spending were often made on gut feelings or incomplete information because getting a clear, up-to-the-minute picture of our financial health was nearly impossible. We’d discover budget overruns weeks, sometimes months, after they happened, by which point it was often too late to do anything but sigh and reallocate funds from elsewhere. This wasn’t just inefficient; it was risky. It meant missed opportunities, wasted resources, and a constant undercurrent of financial anxiety.

The turning point came during a particularly brutal quarter. We’d projected strong sales, but our expenses seemed to be galloping ahead unchecked. By the time we pieced together the full picture, we realized we were significantly off track. It was a wake-up call. We needed something that could tell us, in plain English, where we stood financially, right now, not last week or last month. That’s when I started hearing whispers about an "ERP Budget Monitoring Dashboard." At first, it sounded like another piece of tech jargon, something complicated and out of reach. But desperation is a powerful motivator, and I began to dig deeper.

What I discovered wasn’t just a new tool; it was a completely different way of seeing our finances. Imagine having all your critical budget information, not just dumped in a spreadsheet, but laid out visually, like a command center for your money. That’s essentially what an ERP Budget Monitoring Dashboard promised. It wasn’t a separate system; it was an extension of our existing ERP, designed to pull all the relevant financial data – actual expenditures, committed costs, remaining budget – and present it in an easily digestible format. No more hunting for figures across different files; everything was in one place, constantly updated.

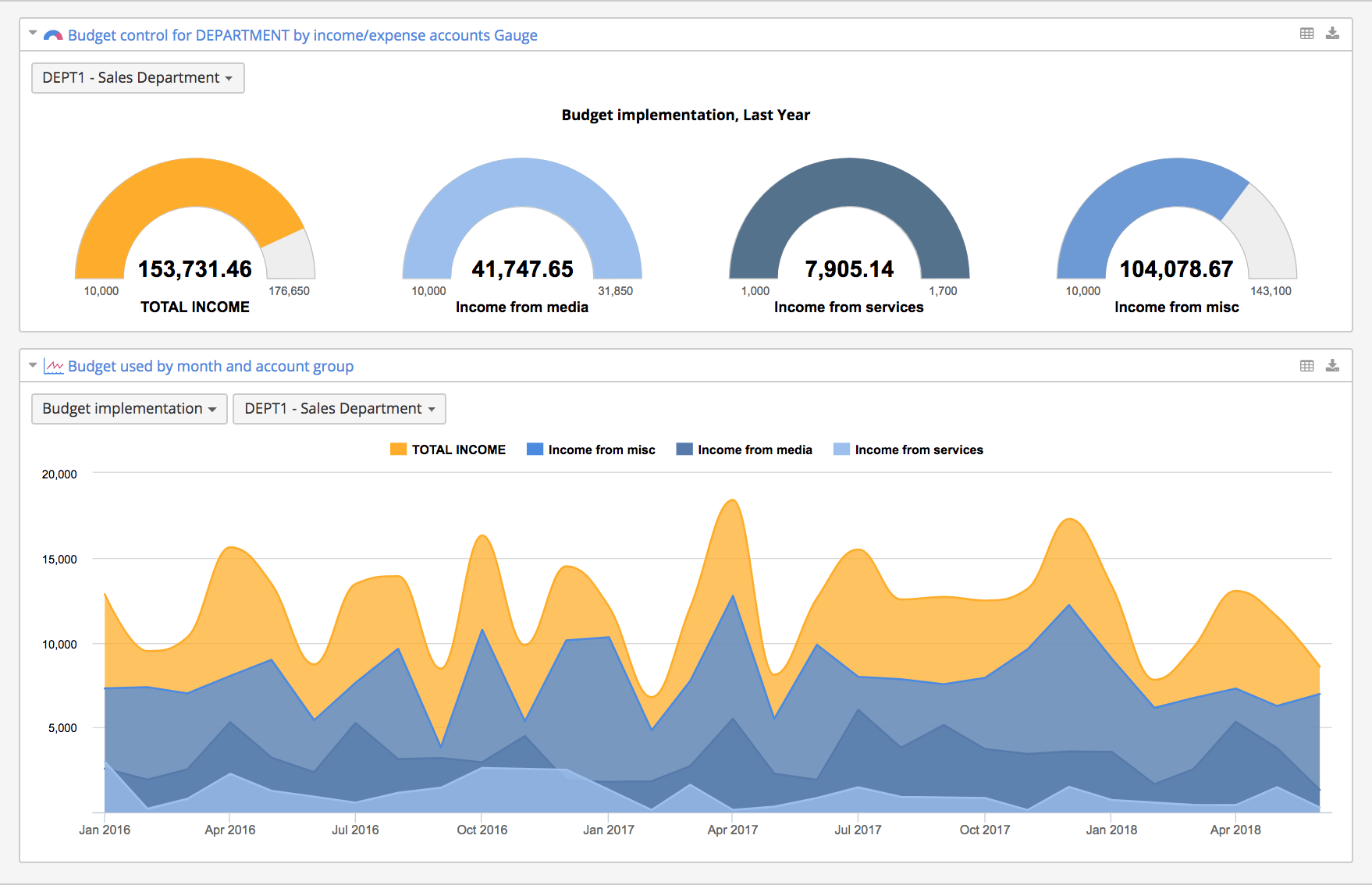

The first time I saw a demonstration, it felt like someone had switched on the lights in a dimly lit room. Instead of rows and columns, I saw colorful graphs showing our departmental spending against budget, gauges indicating our overall financial health, and clear red or green indicators telling me at a glance if we were on track or veering off course. It was an instant connection, a realization that this wasn’t just about numbers; it was about clarity, control, and peace of mind.

So, what exactly makes these dashboards so transformative? Let me tell you about the features that truly changed our game, seen through my own eyes as someone who lived the spreadsheet nightmare.

First and foremost, there’s the real-time data. This was the holy grail for us. Gone were the days of waiting for month-end reports or manually aggregating data. Our ERP dashboard connected directly to our financial modules. Every expense, every purchase order, every invoice that went through our ERP instantly updated the dashboard. This meant that when I checked our marketing budget at 10 AM, I was looking at data that was literally minutes old, not days or weeks. This immediate feedback loop was revolutionary. It allowed us to be proactive. If we saw a particular line item creeping towards its limit, we could address it right away, before it became an overrun. It transformed our financial management from a reactive exercise into a dynamic, ongoing process.

Then there’s the power of visualizations. As I mentioned, my brain struggled with endless tables of numbers. The dashboard presented information visually, making complex data immediately understandable. Bar charts showed us departmental spending at a glance, allowing for quick comparisons. Pie charts broke down expense categories, revealing where our money was truly going. Trend lines helped us spot patterns over time – perhaps our utility costs were consistently higher in certain months, or our travel expenses peaked after particular sales cycles. These visual cues made it easy to identify anomalies and opportunities without getting lost in the details. It was like having a skilled financial analyst distill pages of reports into a single, intuitive image.

One of the most powerful aspects was the drill-down capability. While the visuals gave us the big picture, sometimes we needed to dig deeper. With a click of a button, I could go from a high-level overview of our operational expenses to seeing every single transaction that contributed to that number. If the marketing budget was showing an impending overrun, I could click on the marketing bar chart, then click on the "events" category, and see a list of every event-related expense, who authorized it, and when. This transparency was invaluable for accountability and for understanding the root causes of any deviations. It empowered us to ask specific questions and get immediate answers, without having to badger the finance team for custom reports.

Alerts and notifications were another game-changer. Imagine setting a threshold – say, "notify me if our software subscription budget reaches 80% utilization." The dashboard could be configured to send me an email or a notification right there on the screen when that threshold was met. This meant I didn’t have to constantly babysit the numbers. The system was doing the monitoring for me, flagging potential issues before they escalated. It was like having a tireless financial assistant, always keeping an eye on things, allowing me to focus on strategic tasks rather than constant data checking.

And what about customization? This was crucial for our diverse departments. While I needed a high-level view, our sales manager needed to see her team’s travel and entertainment budget in granular detail. Our operations head focused on supply chain costs. The beauty of the dashboard was that it could be tailored to specific roles and needs. Each user could have a personalized view, showing them only the data relevant to their responsibilities, presented in a way that made the most sense to them. This not only improved usability but also fostered a sense of ownership over budgets within each department. Everyone knew their numbers, understood their impact, and could make informed decisions within their purview.

The impact of this shift was profound.

Improved decision-making became a cornerstone of our operations. No more guessing. With accurate, real-time data at our fingertips, every spending decision, every resource allocation, was grounded in fact. We could quickly assess the financial impact of a new project, evaluate the ROI of marketing campaigns mid-flight, or decide whether to invest in new equipment with confidence. It moved us from reactive firefighting to proactive, strategic planning.

Enhanced accountability spread throughout the company. When everyone had access to their own budget performance, and could see how their spending impacted the bigger picture, it naturally led to greater responsibility. Department heads no longer waited for finance to tell them they were over budget; they saw it happening in real-time and could take corrective action themselves. This fostered a culture of financial awareness that simply didn’t exist before.

Perhaps most tangibly, we saw cost savings and efficiency gains. By spotting potential overruns early, we could negotiate better deals, pause unnecessary spending, or reallocate funds more effectively. We identified areas where we were consistently spending more than anticipated and could then investigate why, leading to process improvements or vendor changes. It wasn’t about cutting corners; it was about spending smarter.

The dashboard also significantly improved our risk mitigation. Unexpected financial surprises became a rarity. We could identify potential cash flow issues, forecast shortfalls, or spot unusual spending patterns that might indicate fraud or waste. This early warning system gave us the time to develop contingency plans and protect the financial health of the business.

Finally, and this might sound a bit dramatic, it gave me back my time and my peace of mind. The hours I used to spend wrestling with spreadsheets were freed up. I could now dedicate that time to more strategic thinking, to understanding market trends, or to collaborating with other departments on growth initiatives. The constant worry about hidden financial pitfalls diminished. I finally felt like I was driving the car, rather than being dragged behind it.

Implementing the dashboard wasn’t without its own little journey, of course. It wasn’t just a switch you flicked. The biggest initial hurdle was ensuring data quality. An ERP dashboard is only as good as the data flowing into it. We had to spend some time cleaning up our existing data, standardizing entry processes, and making sure everyone understood the importance of accurate information. This was a crucial step, and I cannot stress enough how vital it is. Garbage in, garbage out, as they say.

There was also a learning curve for our team. While the dashboard was designed to be intuitive, any new system requires adjustment. We conducted training sessions, encouraged experimentation, and slowly but surely, people began to embrace it. It helped that the benefits were so immediately apparent – seeing your own budget in real-time and understanding where you stand is a powerful motivator.

My advice to anyone considering this path, based on my own experience, would be this:

- Start with a clear vision: What specific problems are you trying to solve? For us, it was the lack of real-time visibility and the endless manual work.

- Involve key stakeholders early: Get your finance team, department heads, and even some key individual contributors on board from the beginning. Their input will be invaluable, and their buy-in is essential for adoption.

- Focus on data quality first: Seriously, make sure your underlying ERP data is clean and consistent. This will save you countless headaches down the line.

- Don’t try to boil the ocean: You don’t need to build the perfect, most comprehensive dashboard on day one. Start with the most critical metrics and expand from there. Iterative development allows you to learn and refine as you go.

- Embrace the change: It’s a shift in mindset, not just a new tool. Encourage your team to use it, explore it, and rely on it. The more it becomes integrated into daily operations, the more value you’ll extract.

Looking ahead, I see the ERP Budget Monitoring Dashboard not just as a tool, but as a foundation for even greater things. It’s paved the way for more sophisticated financial forecasting, allowing us to simulate different scenarios and understand their potential budgetary impact. It’s also deepened our understanding of key performance indicators, helping us connect operational efficiency directly to financial outcomes. It’s moved us beyond simply tracking money to truly understanding the story our numbers are telling us.

The journey from budgeting blunders to financial clarity has been transformative for our company, and for me personally. The ERP Budget Monitoring Dashboard didn’t just automate a process; it empowered us with knowledge. It turned what was once a source of dread and frustration into a wellspring of insight and control. If you’re a business owner or a financial professional still drowning in spreadsheets, constantly playing catch-up, I can tell you from firsthand experience: there’s a better way. There’s a way to turn your numbers into your most trusted advisors, and it starts with a dashboard that brings your budget to life. It’s about moving from simply managing money to truly mastering it, and that, my friends, is a truly liberating feeling.