I remember a time, not so long ago, when the mere mention of bank reconciliation would send shivers down the spines of finance professionals, especially those working in banks. It was a Herculean task, a monotonous marathon of matching entries, often spread across countless paper printouts and endless spreadsheets. I’ve seen my share of late nights, surrounded by piles of bank statements and ledger printouts, squinting at transaction codes, trying to find that one elusive discrepancy that threw everything off balance. It was a manual dance, fraught with human error, and frankly, a colossal waste of precious time and talent.

For financial institutions, bank reconciliation isn’t just a routine accounting task; it’s the heartbeat of financial integrity. Imagine a bank, dealing with millions of transactions daily – deposits, withdrawals, transfers, loan payments, international remittances. Each one of these movements needs to be accurately reflected in the bank’s internal ledger and match what the external bank statement says. If these don’t align, it’s not just an inconvenience; it’s a critical vulnerability. Discrepancies can hide errors, signal potential fraud, impact liquidity management, and even lead to regulatory non-compliance. Regulators, quite rightly, demand impeccable accuracy and transparency. So, while the process felt like a drudgery, its importance was paramount. It was about trust, security, and the very stability of the financial system.

Back in those manual days, the process was something like this: we’d receive stacks of physical or digital bank statements. Then, we’d open up our internal general ledger, often a separate system or even a monstrous spreadsheet. The actual reconciliation involved someone, usually a team of people, going line by line. They’d mark off matching transactions with highlighters, manually investigate anything that didn’t immediately match, and then painstakingly document every single difference. A forgotten check, a delayed transfer, a bank fee miscoded – each tiny anomaly could mean hours, sometimes days, of detective work. It was reactive, slow, and by the time we had a clear picture, the financial landscape might have already shifted. The delay in identifying discrepancies meant a delay in addressing potential issues, whether it was a customer complaint, an operational glitch, or something more sinister.

Then, slowly but surely, the whispers of "Enterprise Resource Planning" or ERP systems began to grow louder. Initially, many of us, myself included, saw ERPs as these grand, complex beasts primarily for manufacturing or large corporations, managing inventory and supply chains. But as these systems matured, their capabilities expanded, reaching into the core functions of finance. The idea was simple yet revolutionary: integrate all core business processes – including financial ones – into a single, unified system. For banks, this meant bringing general ledger, accounts payable, accounts receivable, and crucially, cash management, under one digital roof.

The promise of automated bank reconciliation within an ERP system felt almost too good to be true. It was like moving from drawing maps by hand to using a GPS. The fundamental concept was to automate the comparison of the bank’s internal cash ledger with the bank statements received from external financial institutions. Instead of human eyes scanning lines, algorithms would do the heavy lifting.

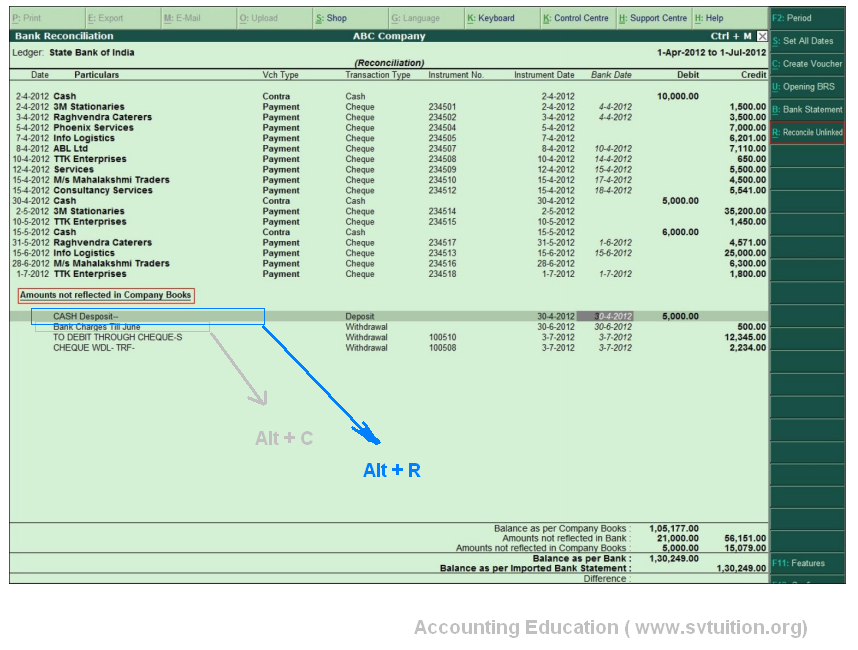

Let me walk you through how it works, based on my experience implementing and using these systems. The first step is getting the data in. This is critical. Modern ERP systems are designed to seamlessly import bank statements, often in standardized electronic formats like SWIFT MT940 or BAI2. Instead of waiting for a physical statement, these files can be transmitted daily, sometimes even multiple times a day, directly from the bank’s banking partner to the ERP. Simultaneously, the ERP system already holds all the internal transactions – the debits and credits posted to the bank accounts in the general ledger.

Once both sets of data are inside the ERP, the magic truly begins. The system employs sophisticated matching rules. Think of these rules as highly intelligent detectives. They look for specific criteria to pair transactions. The simplest rule is a one-to-one match: same amount, same date, same reference number. A deposit of $1,000 on January 5th from "Client A" in the bank statement perfectly matches a credit of $1,000 on January 5th from "Client A" in the ledger. Easy.

But life, and banking, isn’t always that simple. Sometimes, a single bank statement transaction might correspond to multiple internal ledger entries. For instance, a bulk payment from a corporate client might cover several smaller invoices. The ERP’s matching engine can handle these "many-to-one" scenarios, summing up internal entries to match a single external one. Conversely, a single internal entry, like a payroll disbursement, might appear as multiple individual transactions on the bank statement. The system is smart enough to link these "one-to-many" relationships too.

And what about transactions that aren’t perfectly aligned? Maybe a small bank fee that was slightly different than anticipated, or a timing difference where a check was recorded in the ledger but hasn’t cleared the bank yet. This is where "fuzzy matching" comes into play. The system can be configured with tolerance levels, allowing for minor variations in amounts or dates, and still suggest a match, flagging it for human review rather than ignoring it entirely. It’s like a smart assistant saying, "Hey, these look really similar, but there’s a tiny difference. Want me to confirm?"

Of course, not everything matches automatically. There will always be exceptions. These are the truly unmatched items, the ones that require human intervention. The beauty of the ERP system is that it doesn’t just leave you with a pile of unmatched transactions; it presents them in a clear, organized dashboard. You see immediately what’s still open, allowing your team to focus their energy on investigation rather than manual matching. Common reasons for unmatched items include bank errors, company errors (like incorrect posting), timing differences (deposits in transit, outstanding checks), or unknown transactions that might signal something more serious like fraud. The ERP facilitates this investigation by providing drill-down capabilities, allowing users to quickly access underlying transaction details.

The transformation I witnessed was profound. The most immediate benefit was the sheer speed and efficiency. What once took days of painstaking effort could now be completed in hours, sometimes even minutes, especially for daily reconciliations. This wasn’t just about saving labor; it was about freeing up skilled finance professionals from mundane data entry to focus on analysis, strategy, and problem-solving. They could now investigate root causes of discrepancies rather than just finding them.

Accuracy skyrocketed. Automated systems, when configured correctly, don’t make transposition errors or miss a line item because they’re tired. They follow the rules precisely every single time. This reduction in errors built greater confidence in our financial data, which is invaluable for any financial institution.

Fraud detection became significantly more proactive. When reconciliation is automated and happens frequently, unusual transactions or discrepancies surface almost immediately. A fraudulent withdrawal or an unauthorized transfer would stick out like a sore thumb on the exception report, giving the bank a much faster window to react, investigate, and mitigate potential losses. In the manual world, such an item might go unnoticed for days or even weeks, by which time the funds could be long gone.

Perhaps one of the most impactful changes was the real-time visibility it provided. Instead of waiting until the end of the month for a complete picture of cash, we could have an accurate view of our cash position daily, sometimes even intra-day. This real-time insight into liquidity is gold for banks. It allows for better cash management decisions, optimizing investments, ensuring sufficient funds for operations, and minimizing borrowing costs. It’s about knowing exactly where you stand, financially, at any given moment.

Regulatory compliance also became less of a burden. With automated reconciliation, generating audit trails and compliance reports became much simpler. The system could log every transaction, every match, every manual adjustment, providing an indisputable record for auditors and regulators. This ease of compliance not only saved time during audits but also instilled greater confidence in the integrity of our financial reporting.

My journey with implementing these systems across various financial institutions taught me a lot. It’s not just about buying software; it’s about a strategic change. Choosing the right ERP system is paramount. It needs to be robust, scalable, and flexible enough to handle the unique complexities of banking transactions. It also needs to integrate well with existing legacy systems, because let’s face it, tearing everything out and starting from scratch is rarely an option in large financial organizations. Data integration is often the trickiest part – ensuring clean, consistent data flows between disparate systems is a continuous effort.

Customization is another key consideration. While out-of-the-box features are great, banks often have specific internal processes or regulatory requirements that necessitate some level of tailoring. This could involve creating custom matching rules, developing unique reports, or integrating with specialized banking modules. Getting this right requires close collaboration between finance, IT, and the ERP vendor.

And then there’s the human element: training and user adoption. People are naturally resistant to change, especially when it involves altering deeply ingrained routines. Comprehensive training, clear communication about the benefits, and strong leadership support are essential to ensure that employees embrace the new system rather than seeing it as a threat. I’ve found that demonstrating the "before and after" impact, showing them how much easier their lives will become, is a powerful motivator.

Of course, the path to automation isn’t without its bumps. Data quality issues are a recurring challenge. If the data coming from the bank statement or your internal ledger is messy, incomplete, or inconsistent, even the most sophisticated ERP system will struggle to reconcile it. "Garbage in, garbage out" applies perfectly here. Investing in data cleansing and data governance initiatives before and during implementation is crucial.

Complex transactions, particularly those involving multiple currencies, international transfers with various fees, or intricate financial instruments, can still pose challenges for automated matching. While ERPs are getting smarter, some highly nuanced scenarios may still require a degree of manual oversight or specialized rule configuration. The key is to design the system to handle the vast majority of routine transactions, freeing up human experts to focus on these more complex exceptions.

Resistance to change, as I mentioned, is a significant hurdle. Some employees, comfortable with their old ways, might view the automation as a threat to their job security or simply be reluctant to learn new tools. It’s important to reframe their roles, emphasizing how automation elevates them from data processors to financial analysts, adding more value to the organization.

Looking ahead, the future of automated bank reconciliation is even more exciting. We’re already seeing the integration of Artificial Intelligence (AI) and Machine Learning (ML) into these systems. Imagine an ERP system that not only matches transactions based on predefined rules but also learns from past manual reconciliations. It could identify patterns in unmatched items, suggest solutions for recurring discrepancies, and even predict potential issues before they arise. Predictive analytics could help banks anticipate cash flow needs more accurately, further optimizing liquidity. AI could also enhance fraud detection by identifying highly anomalous transactions that deviate from established behavioral patterns, even if they don’t violate existing rules.

In closing, the journey from manual, error-prone bank reconciliation to a streamlined, automated process within an ERP system has been nothing short of a revolution for financial institutions. It transformed a tedious compliance exercise into a powerful tool for efficiency, accuracy, fraud prevention, and strategic financial management. It allowed banks to gain real-time insights, meet regulatory demands with greater ease, and ultimately, serve their customers better by operating on a foundation of robust, reliable financial data. It’s a testament to how technology, when thoughtfully applied, can truly elevate an entire industry, freeing up human potential to focus on what truly matters: innovation, analysis, and building a more secure financial future.