The Day My Business Finances Finally Made Sense: My Journey with ERP Digital Payment Tracking

Let me tell you a story. It’s not a grand adventure or a thrilling mystery, but it’s a story about a quiet revolution that happened right in the heart of my business – a revolution that transformed chaos into calm, and guesswork into certainty. It’s the story of how I discovered something called ERP Digital Payment Tracking, and how it changed everything for the better.

Chapter 1: The "Before" – Drowning in a Sea of Paper and Uncertainty

Picture this: my office, just a few years ago. It wasn’t quite a disaster zone, but it was getting there. Every month, a fresh wave of invoices, receipts, and bank statements would crash onto my desk. Our business was growing, which was fantastic, but with growth came complexity.

We were dealing with dozens of vendors, a growing list of customers, and multiple payment methods. Some payments came in via bank transfer, others through online gateways, some still by check (yes, really!). Each one needed to be meticulously recorded, matched against an invoice, and then reconciled with our bank account.

My team and I spent what felt like endless hours:

- Chasing missing payments: "Did Mrs. Henderson pay that invoice yet? I can’t find it!"

- Hunting down vendor bills: "Where’s the invoice for that last software subscription? It’s due tomorrow!"

- Manually entering data: Typing payment details from a bank statement into our accounting software, then cross-referencing it with our records. It was mind-numbing, prone to errors, and honestly, a huge drain on our productivity.

- Reconciliation nightmares: At the end of the month, trying to make sure every single payment in our books matched what was actually in the bank was a Herculean task. Discrepancies were common, leading to late nights and a gnawing feeling of "are we really sure about this?"

The worst part? We never truly had a clear, real-time picture of our cash flow. We were always looking backward, reacting to problems instead of proactively managing our finances. This constant uncertainty was a major source of stress for me and my team.

Chapter 2: The Lightbulb Moment – What Exactly is ERP Digital Payment Tracking?

One day, I was venting my frustrations to a friend who runs a slightly larger company. He listened patiently, then simply said, "You need an ERP system, specifically for your payment tracking."

"An what now?" I asked, feeling a bit out of my depth.

He explained it to me in simple terms. ERP stands for Enterprise Resource Planning. Think of it as a central nervous system for your entire business. Instead of having separate, disconnected systems for accounting, sales, inventory, and operations, an ERP system brings all that data together into one unified platform.

And the "Digital Payment Tracking" part? That’s where the magic truly happens for finances. He described it as a feature within an ERP system that automates, tracks, and manages all incoming and outgoing digital payments. It links payments directly to invoices, purchase orders, and customer/vendor accounts, all in one place, in real-time.

It sounded almost too good to be true. No more manual entry? Real-time visibility? Automated reconciliation? My interest was piqued. This wasn’t just about moving from paper to digital; it was about moving from fragmented information to a holistic, connected view of our financial pulse.

Chapter 3: My First Steps – Embracing the Change (and the Initial Jitters)

The idea of implementing an entirely new system felt daunting. Would it be too expensive? Too complicated for my team? Would it disrupt our operations? These were all valid concerns, and I won’t lie, there were definitely some initial jitters.

We started by researching different ERP solutions. We looked for systems that were user-friendly, scalable for our growing business, and, most importantly, had robust digital payment tracking capabilities. We talked to other business owners, read reviews, and even got a few demos.

The implementation process wasn’t instantaneous, but it was smoother than I anticipated. The chosen ERP vendor provided excellent support, guiding us through data migration and user training. My team, initially hesitant, quickly started seeing the benefits. Learning a new system always takes a little effort, but the promise of less manual work and fewer headaches was a powerful motivator.

We began by integrating our bank accounts and payment gateways directly into the ERP. This was the foundation. From there, we configured rules for how payments should be matched to invoices, how notifications should be sent, and how reports should be generated. It felt like we were building a custom financial control panel for our business.

Chapter 4: The Game-Changer: How ERP Digital Payment Tracking Transformed My Business

Once the system was up and running, the transformation was almost immediate and truly profound. Here’s how ERP Digital Payment Tracking became our financial superhero:

-

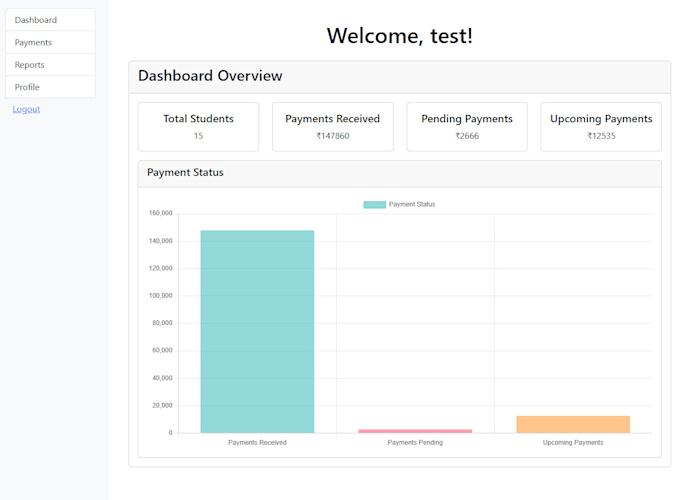

Real-Time Visibility into Cash Flow: This was perhaps the biggest win. I no longer had to wait until the end of the month, or even the end of the week, to understand our financial standing. With a few clicks, I could see exactly what payments had come in, what bills were due, and our projected cash balance. It was like switching on a powerful spotlight in a previously dim room. This real-time payment tracking empowered us to make informed decisions faster.