From Ledger Books to Lightning Speed: My Journey with ERP Employee Payroll Processing

Let me tell you a story. It’s a story many in the world of business, especially those who’ve been around for a while, can relate to. It’s a tale of transformation, from the chaotic labyrinth of manual paperwork to the streamlined efficiency of modern technology. My story is about ERP Employee Payroll Processing, and how it utterly changed my professional life.

The Old Nightmare: When Payroll Meant Piles of Paper and Panic Attacks

Picture this: It’s the mid-2000s, and I was deeply involved in the administrative side of a growing medium-sized company. My desk was a fortress of folders, each one representing an employee, filled with timesheets, tax forms, benefits enrollment papers, and deduction slips. The air would thicken with dread as "payroll week" approached.

You know those nightmares where you’re running but not moving, or trying to solve a puzzle with missing pieces? That was payroll for me. Every single month (or bi-weekly, depending on the pay cycle), it was a meticulous, mind-numbing process of:

- Collecting Timesheets: Chasing down late submissions, deciphering illegible handwriting, and double-checking hours. A missing timesheet meant a frantic search or an annoyed employee.

- Manual Calculations: Pulling out a calculator, sometimes even a spreadsheet, to tally regular hours, overtime, sick leave, vacation. Then came the deductions: health insurance, 401k contributions, union dues, garnishments. Each one had to be manually subtracted. One wrong keystroke, one missed decimal, and the entire pay run was off.

- Tax Compliance Headaches: Oh, the taxes! Federal, state, local… each with its own rules, thresholds, and reporting requirements. Staying updated on changing tax laws was a full-time job in itself. And then came the quarterly and annual filings – filling out those complex forms by hand, praying no errors would invite an audit.

- Printing and Distribution: Stacks of paper pay stubs, carefully folded and sealed, then distributed. Imagine the questions, the disputes, the "my pay is wrong!" complaints that would flood in, requiring me to dig back through those paper folders to find the source of the discrepancy.

- Bank Reconciliation: Manually preparing bank files for direct deposits, or even worse, printing and signing actual checks.

It wasn’t just tedious; it was stressful. The stakes were incredibly high. Employees rely on their paychecks to live, to pay bills, to feed their families. A mistake wasn’t just an error; it was a breach of trust, a financial hardship for someone. I often worked late into the night, fueled by caffeine and the sheer terror of missing a deadline or making a costly mistake. My team and I were constantly putting out fires, leaving little time for strategic thinking or improving other HR processes.

A Glimmer of Hope: Discovering ERP

Then came the turning point. Our company leadership, seeing the mounting operational inefficiencies and the strain on our team, decided it was time for a change. They talked about something called "ERP" – Enterprise Resource Planning.

Initially, I was skeptical. Another acronym, another "solution" that would probably just add more complexity. But as they explained it, something clicked. ERP wasn’t just about accounting or inventory; it was an integrated system designed to manage all core business processes – from finance and HR to manufacturing and supply chain – in one unified platform. And critically, it included Employee Payroll Processing.

The idea was revolutionary: instead of disparate systems and manual data entry, all our employee data – from their initial hiring information to their attendance records and benefits choices – would reside in a single, central database. This meant that when it came to payroll, much of the heavy lifting could be automated.

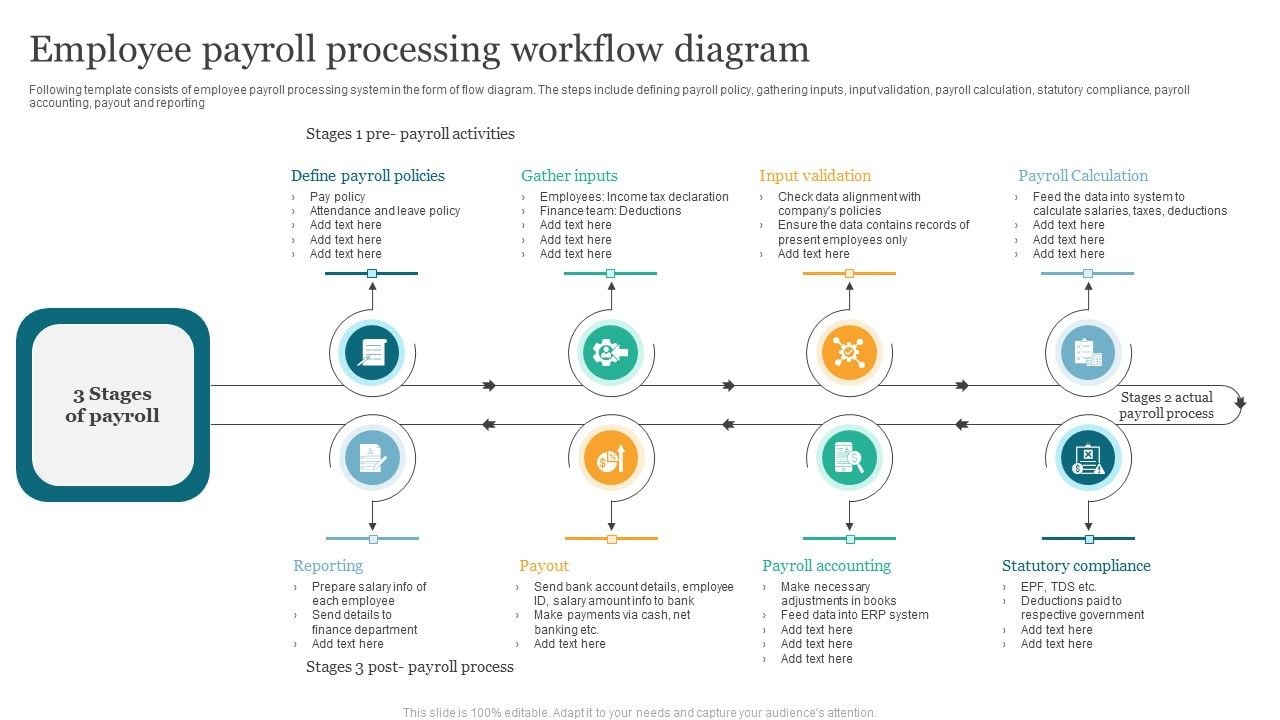

The Magic Behind the Scenes: How ERP Payroll Processing Works

When we finally implemented our ERP system, the transition wasn’t without its challenges – migrating years of historical data was a beast! But once it was up and running, the difference was like night and day. Let me break down how ERP Employee Payroll Processing works, in a way that even a complete beginner can understand:

- Centralized Employee Data: Imagine a single digital file for every employee. This file contains everything: their personal details, job title, salary, bank account for direct deposit, tax withholding information (W-4 equivalent), and all their chosen benefits (health insurance, retirement plans). This data is often pulled directly from the HR module of the ERP.

- Automated Time & Attendance Integration: No more chasing timesheets! Many ERP systems integrate seamlessly with time tracking solutions (like clock-in/clock-out systems or project management tools). Employee hours are automatically fed into the payroll module. For salaried employees, their regular pay is simply pulled from their salary record.

- Calculation Engine: This is where the real magic happens. The ERP system has a powerful calculation engine that automatically:

- Calculates gross pay (regular hours x rate + overtime + bonuses).

- Applies all pre-tax deductions (like 401k contributions, which reduce taxable income).

- Calculates and withholds all relevant taxes (federal, state, local income tax, FICA, etc.). Crucially, the system is constantly updated with the latest tax laws and regulations, so you don’t have to manually track changes.

- Applies all post-tax deductions (like health insurance premiums, garnishments, loan repayments).

- Determines the final net pay.