I remember a time, not so long ago, when the sound of rustling paper and the frantic tapping of calculator keys were the background music of almost any business office. Invoices were a mountain of documents, meticulously entered, cross-referenced, and then, often, re-entered somewhere else. It was a messy, error-prone world, and frankly, it was a constant headache for anyone involved in the money side of things. My own journey through various businesses, from a small gadget shop to a mid-sized manufacturing plant, showed me this struggle firsthand, over and over again. The billing department, whether it was one person or a team of ten, always seemed to be fighting a losing battle against time, accuracy, and the sheer volume of tasks.

Picture this: A customer places an order. Great! The sales team is happy. Then, someone has to manually type that order into an invoicing system. But wait, is the pricing correct? Are the discounts applied properly? Did the inventory get updated? Often, the invoicing system was a standalone program, a digital island that didn’t talk to the sales department’s customer relationship management (CRM) tool, or the warehouse’s inventory system. This meant data was copied, pasted, or worse, manually re-typed. Each step was an opportunity for a mistake. A typo in a price, a forgotten discount, an incorrect quantity – all of these led to delays, frustrated customers, and the painful process of issuing credit notes or chasing up underpayments. The reconciliation process at the end of the month? That was a special kind of torture, trying to match payments received with invoices sent, when the numbers just didn’t seem to line up. It was like trying to solve a puzzle with half the pieces missing and the other half from a different puzzle entirely. Cash flow, the lifeblood of any business, was often a mystery until well after the fact. You never quite knew where you stood until someone had spent days crunching numbers, and by then, it might have been too late to address issues.

Then, something shifted. The idea of an Enterprise Resource Planning, or ERP, system started gaining traction. At first, it sounded like a complex, intimidating piece of technology, something only giant corporations could afford or understand. But as I watched businesses grow, and their billing problems grow with them, the concept of a central system that could manage all parts of a business – from sales and inventory to finance and human resources – began to make a lot of sense. The "aha!" moment for me, and for many businesses I worked with, came when we realized that billing didn’t have to be a separate, isolated task. It could, and should, be an integral part of this grand, central brain of the business. This is where ERP integrated billing solutions entered the scene, changing the game completely.

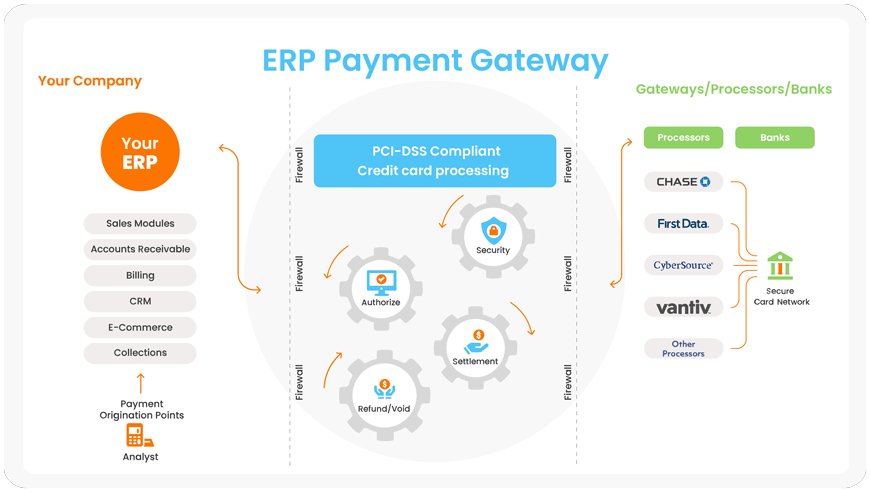

What does "ERP integrated billing" actually mean? In simple terms, it means that your billing process isn’t just a standalone module; it’s deeply connected to every other relevant part of your business operations. Think of it like this: instead of different departments having their own notebooks and trying to share information by shouting across the office, everyone is now writing in the same shared digital ledger. When a sales order is created, that information isn’t just sitting in the sales team’s system; it’s immediately available to the inventory team to prepare the goods, and crucially, to the finance team to generate an invoice. The moment a product is shipped, or a service is completed, the ERP system knows, and it can automatically trigger the creation of an accurate invoice, reflecting the correct items, prices, discounts, and taxes. Payments received are automatically matched to open invoices, and the financial ledgers are updated in real-time. It’s not magic; it’s just smart design.

The benefits of moving to such a system were, and continue to be, profound. One of the most immediate improvements I observed was in accuracy. Gone were the days of manual data entry errors. When the sales order, the inventory record, and the invoice all pull from the same source of truth within the ERP system, the chances of discrepancies drop dramatically. Pricing is consistent, customer details are correct, and tax calculations are automated according to pre-set rules. I remember one client, a wholesale distributor, who used to spend days each month correcting invoice errors. After moving to an integrated system, those error rates plummeted, freeing up their accounting team for more valuable tasks than playing detective with numbers.

This accuracy naturally leads to incredible gains in efficiency and speed. What once took hours, or even days, now happens in minutes. Invoices are generated faster, which means they go out to customers sooner. And when invoices go out sooner, payments tend to come in sooner. This is a direct shot in the arm for a business’s cash flow. Instead of waiting until the end of the month to understand who owes what, a business can see its accounts receivable in real-time. This visibility allows for proactive chasing of late payments and better financial planning. I saw businesses reduce their average payment collection time by several days, simply because their billing process became a quick, smooth operation rather than a series of bottlenecks.

Beyond the immediate financial gains, integrated billing also contributes significantly to cost reduction. Less time spent on manual data entry means fewer labor hours dedicated to repetitive tasks. Fewer errors mean less time spent on corrections, re-issuing invoices, and resolving customer disputes. Businesses also often find they can reduce paper usage and associated printing and mailing costs. While the initial investment in an ERP system can seem substantial, the long-term savings often far outweigh it.

Perhaps one of the most underrated benefits is the improvement in customer experience. Think about it: when a customer receives an accurate, timely invoice that matches their order perfectly, their trust in your business grows. They don’t have to call to dispute charges or clarify details. This smooth, professional interaction builds loyalty. Conversely, a stream of incorrect or late invoices can quickly erode customer confidence and lead to dissatisfaction. I saw a marked decrease in customer service calls related to billing inquiries after businesses made the switch, allowing their support teams to focus on actual product or service-related issues.

For businesses operating in regulated industries, or simply those that value proper financial governance, compliance and reporting become much simpler. ERP systems are built to handle complex tax rules, revenue recognition principles, and financial reporting standards. Generating audit trails, quarterly reports, or annual statements is no longer a monumental task; the data is already organized and accessible. This kind of robust reporting capability gives business leaders a much clearer picture of their financial health, enabling better decision-making. You can analyze sales trends, identify profitable customer segments, and understand your cost structures with an clarity that was impossible with disconnected systems.

And as businesses grow, scalability becomes crucial. A billing system built on spreadsheets or disparate software simply won’t keep up. An integrated ERP solution, however, is designed to handle increasing volumes of transactions, more complex pricing models, and expansion into new markets without breaking a sweat. It grows with you, adapting to your evolving needs rather than becoming a bottleneck.

So, how does this magic actually work in practice? Let’s trace a typical "quote-to-cash" journey within an ERP environment. It usually starts when a customer expresses interest, perhaps through your CRM module, where their details and interactions are stored. A sales representative creates a quote, which, once approved, becomes a sales order. This sales order automatically pulls pricing from your product catalog, applies any relevant discounts, and calculates taxes. All this information is residing in the same central ERP database.

Once the sales order is confirmed, it triggers actions in other parts of the system. The inventory module is updated to reserve the items, or if it’s a service, the project management module might be notified. When the product is shipped (which is recorded in the logistics module) or the service is delivered, the ERP system automatically triggers the creation of an invoice. This invoice draws all the necessary information – customer details, items, quantities, prices, taxes, shipping costs – directly from the original sales order and shipping records. There’s no re-typing, no manual calculations.

The invoice is then sent to the customer, often electronically. When the payment is received, it’s recorded in the finance and accounting module, and the system automatically matches the payment to the open invoice, marking it as paid. This process instantly updates the general ledger, the accounts receivable records, and provides a real-time view of your cash position. Every step of this journey is interconnected, eliminating the need for manual handoffs and the errors that come with them. It’s like a beautifully choreographed dance, where every performer knows their cue and executes it perfectly.

Of course, getting to this state of grace isn’t just about flipping a switch. Choosing the right ERP integrated billing solution requires careful thought. First, you need to deeply understand your own business’s specific needs and complexities. Are you dealing with recurring subscriptions? Project-based billing? Complex pricing tiers? International sales with multiple currencies and tax rules? Your chosen solution needs to be able to handle these intricacies. Don’t just pick a generic system; find one that truly fits your unique operational landscape.

Then comes vendor selection. Look for providers with a strong track record, good customer support, and a system that aligns with your industry. Talk to their existing clients. Ask about implementation timelines and ongoing support. Remember, you’re not just buying software; you’re entering into a long-term partnership.

The implementation process itself is a journey. It involves migrating your existing data, configuring the system to match your business rules, and crucially, training your team. Data migration can be a big undertaking, making sure old records are accurately transferred to the new system. Configuration requires careful planning to ensure the system reflects your pricing, discount structures, tax rules, and reporting needs. And training? That’s perhaps the most important part. No matter how good the software is, it’s only as effective as the people using it. Getting everyone on board, from sales to finance, and ensuring they understand the new workflows, is key to success. This brings us to change management – the human element. People naturally resist change, so clear communication, demonstrating the benefits, and providing ample support are vital to a smooth transition.

Looking ahead, the evolution of ERP integrated billing solutions isn’t stopping. We’re seeing more and more intelligence being built into these systems. Artificial intelligence (AI) and machine learning are starting to play a role, for instance, in predicting payment behaviors, identifying potential fraud, or even suggesting personalized billing plans for customers. Imagine a system that can flag an invoice as potentially problematic before it even goes out, based on historical data. Or one that can automatically adjust payment terms for certain customers based on their credit history and relationship with your business. The future promises even greater automation, predictive analytics, and deeper insights into your financial operations.

My journey through the business world has shown me countless transformations, but few have been as impactful and consistently positive as the shift to ERP integrated billing solutions. It’s more than just a software upgrade; it’s a fundamental change in how businesses manage their money, interact with their customers, and plan for their future. It moves billing from being a reactive, error-prone chore to a proactive, strategic part of the business, laying a solid foundation for growth and stability. If you’re still stuck in the old ways, battling spreadsheets and disconnected systems, trust me, there’s a better path. It’s a path that leads to clearer finances, happier customers, and a lot less stress for everyone involved. And that, in my experience, is a story worth telling.