Let me tell you a story, a story many of you in the world of finance and business might find familiar, one filled with spreadsheets, late nights, and the gnawing anxiety of an impending audit. My name is Alex, and for years, my company, a growing tech firm specializing in subscription services and complex project contracts, was constantly battling the beast that is revenue recognition. It wasn’t just a challenge; it felt like a relentless uphill climb, especially with the introduction of new accounting standards like ASC 606 and IFRS 15. Those acronyms alone were enough to send shivers down my spine.

I remember those days vividly. Our finance team, a dedicated but perpetually overwhelmed group, would spend countless hours at month-end. We had a patchwork system: a CRM for sales, a separate billing system, and a general ledger that felt like it was held together with sticky tape and good intentions. When it came to recognizing revenue, especially for multi-element arrangements – you know, where a customer buys software, gets implementation services, and then pays a monthly subscription – it was a manual nightmare. Each contract had to be scrutinized, performance obligations identified, transaction prices allocated, and then revenue recognized over time or at a point in time, depending on the specifics. We were essentially trying to force square pegs into round holes with every single deal.

The problem wasn’t just the sheer volume of work; it was the risk. One misstep, one manual error in a spreadsheet formula, one overlooked contract amendment, and suddenly, our financial statements could be materially misstated. The thought of an auditor digging into our labyrinthine manual processes, trying to reconcile spreadsheets that had been touched by multiple hands, gave me sleepless nights. I’d wake up in a cold sweat, picturing a sea of red ink on an audit report. It wasn’t just about compliance; it was about trust. Trust from our investors, our board, and even our own internal teams who relied on accurate financial data to make critical business decisions.

The breaking point came after a particularly grueling audit. We passed, thankfully, but barely. The auditors spent weeks poring over our revenue schedules, asking endless questions, and highlighting areas where our manual processes were, to put it mildly, "suboptimal." They suggested, rather strongly, that we needed a more robust, automated solution. That’s when the conversation about ERP Revenue Recognition Tools really started to gain traction in our executive meetings.

At first, I was skeptical. We had already invested so much in our existing systems. Was another large software implementation really the answer? Would it be worth the disruption, the cost, the learning curve? But the alternative – continuing down the path of manual, high-risk processes – was no longer sustainable. We were growing, our contracts were getting more complex, and the regulatory landscape wasn’t getting any simpler. Something had to give.

So, we began our journey into the world of Enterprise Resource Planning (ERP) systems, specifically focusing on their capabilities for revenue recognition. What I learned, and what transformed our operations, was that these aren’t just generic accounting modules; they are sophisticated engines designed to tackle the very complexities that were plaguing us.

Think of an ERP revenue recognition tool as a meticulous, tireless accountant, but one that operates at lightning speed and never makes a mistake. It’s a central nervous system for your financial data. Instead of isolated spreadsheets and disparate systems, an ERP integrates everything. Our sales team would log a new deal in the CRM, which was now connected directly to the ERP. When the contract was signed, the terms, including all performance obligations, billing schedules, and pricing, would flow seamlessly into the ERP’s revenue recognition module.

This was the magic moment for us: automation. The system automatically identified the individual performance obligations within a contract – the software license, the implementation service, the ongoing support, the subscription fee. It then allocated the transaction price to each of these obligations based on their standalone selling prices, or estimated standalone selling prices if direct evidence wasn’t available, all according to ASC 606 guidelines. This alone was a massive relief. No more manual calculations, no more debates about allocation percentages. The system did the heavy lifting, applying the rules consistently every single time.

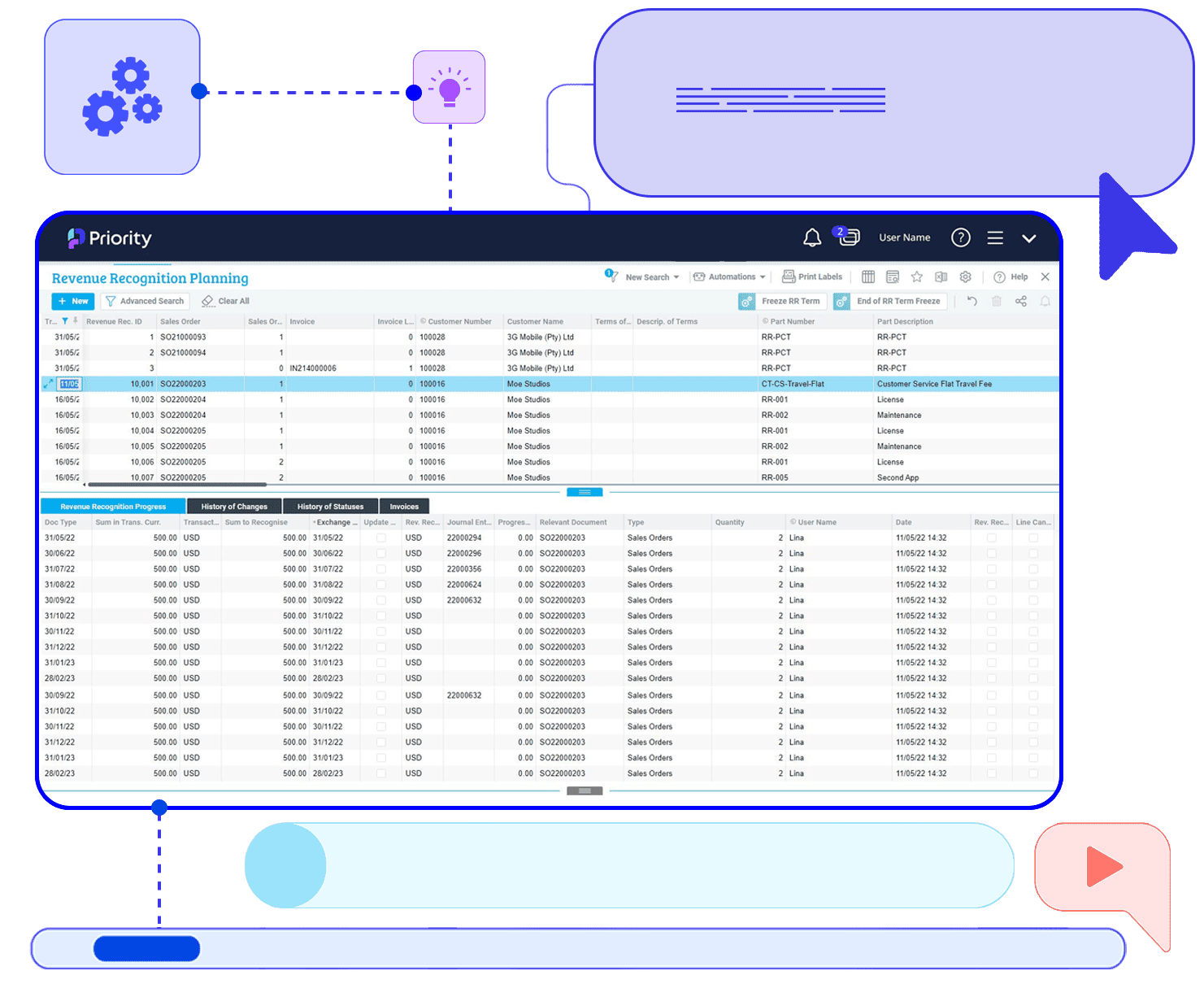

Then came the recognition part. For services like implementation, which were recognized over the period they were performed, the ERP would automatically set up the appropriate deferred revenue schedules and then release revenue as milestones were met or over the service period. For subscriptions, it would recognize revenue ratably each month. For software licenses, it would recognize revenue at the point of transfer. It wasn’t just booking a lump sum anymore; it was a granular, rule-based approach that ensured we were compliant down to the penny.

The impact on our month-end close was phenomenal. What used to take days of painstaking reconciliation now took hours. Our team could spend their time analyzing data, understanding trends, and providing strategic insights, rather than just crunching numbers and chasing errors. That shift in focus was incredibly empowering for them, and for me as a leader.

Beyond automation, the audit trail these ERP tools provided was a revelation. Every single transaction, every allocation, every revenue recognition entry had a clear, traceable path. If an auditor wanted to see how we recognized revenue for a particular contract, we could simply pull up the record in the ERP. It showed the original contract terms, the identified performance obligations, the allocation methodology, the deferred revenue schedule, and every single journal entry. It was all there, transparent and verifiable. Our next audit was, dare I say it, almost pleasant. The auditors were impressed by the clarity and robustness of our processes. The sleepless nights finally stopped.

Let me walk you through some of the specific capabilities that turned our nightmare into a dream:

-

Contract Management: These tools aren’t just about accounting; they often start at the source. They allow you to define and manage contract terms, including pricing, delivery schedules, and performance obligations, all in one place. This ensures consistency from sales to finance. We could define templates for common contract types, making the initial setup much faster and less error-prone.

-

Performance Obligation Identification and Allocation: This is the heart of ASC 606 and IFRS 15. The ERP helps you break down complex contracts into their individual components (the "performance obligations") and then systematically allocate the total transaction price to each based on predefined rules or estimated standalone selling prices. It takes away the guesswork and ensures compliance.

-

Revenue Scheduling and Recognition: Once allocations are done, the system automatically creates revenue recognition schedules. Whether revenue needs to be recognized immediately, over time, or based on specific milestones, the ERP handles it. It posts the necessary journal entries automatically, reducing manual effort and eliminating transcription errors. This was a massive win for managing deferred revenue accurately.

-

Integration with Other Modules: This is key. A good ERP revenue recognition tool isn’t a standalone island. It integrates seamlessly with your CRM (for contract data), your billing system (for invoicing), your project management module (for tracking progress on services), and your general ledger. This interconnectedness ensures a single source of truth and eliminates data silos. For us, this meant that when a customer paid an invoice, the system knew exactly how that payment related to recognized revenue versus deferred revenue.

-

Compliance and Reporting: The system is built with ASC 606 and IFRS 15 guidelines in mind. It provides the necessary reports for disclosure requirements, such as disaggregation of revenue, contract asset/liability balances, and reconciliation reports. Generating these used to be a separate, Herculean task; now, it’s a few clicks away. We could instantly see our recognized revenue by product line, by geography, by contract type – insights we simply couldn’t get easily before.