I remember a time, not so long ago, when the mere mention of "expense reports" would send a shiver down the spine of almost everyone in the office. It was a chore, a burden, a necessary evil that no one looked forward to. As someone who’s worn many hats in different businesses, from a fledgling startup to a bustling mid-sized company, I’ve seen the evolution of how we handle staff expenses, and let me tell you, the transformation brought about by proper ERP staff expense tracking is nothing short of revolutionary. It’s a story of moving from a world of crumpled receipts and endless frustration to one of smooth, automated efficiency.

My first encounter with staff expense tracking was in a small design agency. We were a passionate bunch, always on the go, meeting clients, traveling for projects, and grabbing quick lunches. Every month, a wave of dread would wash over us. The finance manager, a wonderfully patient woman named Sarah, would put out the call: "Expenses are due!" And then the scramble would begin. People would rummage through their wallets, desk drawers, and car glove compartments, desperately searching for those tiny, faded slips of paper.

I recall spending entire evenings meticulously taping receipts to A4 sheets, trying to decipher the blurry figures, and painstakingly typing them into a spreadsheet. Sometimes, a crucial receipt would be missing – a taxi fare, a coffee with a client – and then it was a guessing game, or worse, an uncomfortable conversation with Sarah, trying to explain why a particular expense couldn’t be fully reimbursed. The process was slow, prone to errors, and frankly, a massive drain on everyone’s time. Employees felt annoyed by the administrative overhead, and the finance team was swamped with manual data entry, chasing missing information, and reconciling disparate figures. This wasn’t just about small amounts; it was about the cumulative impact on productivity and morale. Our business expense tracking was a mess.

Sarah, bless her heart, would spend days trying to cross-reference these manual reports with bank statements, credit card statements, and project codes. Imagine the mental gymnastics! She’d often find discrepancies, leading to more back-and-forth emails, more corrections, and delays in reimbursements. This wasn’t just inconvenient; it tied up cash flow for employees and created a sense of distrust. When reimbursements were delayed, it affected people’s personal finances, which in turn could impact their focus at work. We were essentially paying people to do administrative tasks that added little value to our core business. The lack of real-time financial visibility meant budgeting was more of an educated guess than a precise science. We never truly knew our spending patterns until weeks after the money was gone.

Then came my move to a slightly larger manufacturing company. Here, the scale of the problem was amplified. We had a sales team constantly on the road, field service engineers visiting sites, and executives traveling internationally. The volume of employee expenses was staggering. They had a slightly more "advanced" system – a custom-built Excel monstrosity with a hundred tabs and complex macros that only one person in the company understood. When that person went on vacation, the whole system ground to a halt.

It was during my time there that the management finally decided enough was enough. The lost productivity, the audit risks from poor record-keeping, and the sheer frustration were too high a cost. They started talking about an "ERP system." Honestly, at first, it sounded like some mythical beast. Enterprise Resource Planning – a big, complex software suite that promised to tie everything together. My ears perked up when they mentioned a module specifically for expense management. Could it really be the answer to our staff expense tracking woes?

The journey of implementing an ERP system, even just for expense tracking, was an eye-opener. It wasn’t just about buying software; it was about rethinking our entire process. We had to define clear expense policies – what was reimbursable, what wasn’t, what were the limits for meals, accommodation, and travel. This was a crucial first step, as a digital system needs clear rules to follow. Before, these policies were often vague, leading to subjective interpretations and inconsistencies. With ERP, we had to formalize them, which, while challenging, ultimately brought much-needed clarity.

The core idea of ERP staff expense tracking, as I came to understand it, was automation and integration. Imagine this: an employee incurs an expense. Instead of stuffing a receipt into their wallet, they pull out their phone, snap a picture of it using a dedicated mobile expense app, and upload it instantly. The ERP system then uses optical character recognition (OCR) to read the key details from the receipt – vendor, date, amount. It automatically categorizes the expense based on predefined rules. No more manual data entry!

This was a game-changer for the employees. They could submit expenses on the go, often right after the purchase, preventing lost receipts and the dreaded end-of-month scramble. The system would guide them, ensuring they filled in all necessary information, like attaching it to a specific project or client. If an expense exceeded a policy limit, the system would flag it immediately, prompting the employee to provide a justification or adjust the amount. This immediate feedback was invaluable; it helped employees understand and adhere to company policies in real-time, rather than discovering an issue weeks later.

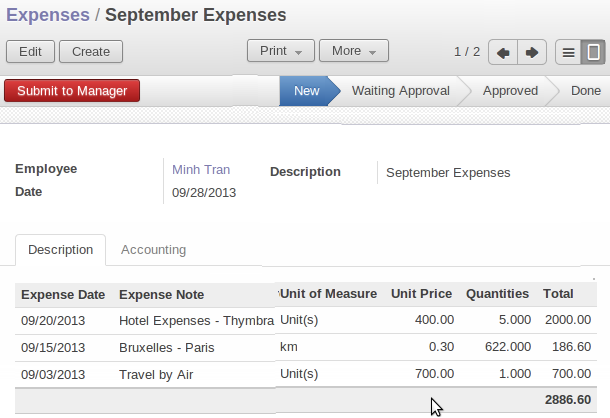

For managers, the approval workflow was transformed. Instead of a pile of paper reports landing on their desk, they received notifications on their computers or phones. They could review the expense details, the attached receipt, and any policy flags with a few clicks. The system ensured that expenses were routed to the correct approver based on the department, project, or amount. This significantly sped up the approval process, reducing bottlenecks and ensuring timely reimbursements. The transparency was also a huge plus; managers could see the full audit trail – who submitted, when, who approved, and when – fostering accountability.

But the real magic, for me, was what it did for the finance team. Sarah, or in the manufacturing company’s case, the entire finance department, was liberated from the drudgery of manual data entry and reconciliation. The ERP system automatically fed approved expenses into the general ledger. It integrated seamlessly with our accounting software and payroll system. This meant that once an expense was approved, it was automatically ready for reimbursement through payroll, and the accounting records were updated instantly.

Think about the implications:

- Accuracy and Compliance: No more deciphering illegible handwriting or lost receipts. The digital record is clear, timestamped, and tied to the original receipt image. This greatly improves compliance with tax regulations and internal policies. The robust audit trail makes it easier to respond to inquiries or actual audits.

- Real-time Financial Visibility: Finance teams could see expense data as it happened, not weeks or months later. This allowed for much better cost control and budgeting. They could identify spending trends, flag unusual expenses, and allocate resources more effectively. Imagine being able to see, mid-month, that travel expenses are trending higher than budget, and then being able to take corrective action before the month ends. This was impossible with manual systems.

- Time and Cost Savings: The time saved across the board was immense. Employees spent less time on admin, managers spent less time approving, and finance spent dramatically less time on processing. This translated directly into cost savings, as valuable employee hours were redirected to core business activities. Less paper, less printing, less storage – small savings that add up.

- Employee Satisfaction: This is often overlooked, but happier employees are more productive employees. Timely reimbursements, a straightforward submission process, and clear policies reduce stress and foster a sense of trust. Employees feel respected when their time isn’t wasted on cumbersome administrative tasks.

- Fraud Prevention: With clear policies, automated flagging of unusual expenses, and a transparent audit trail, the opportunities for expense fraud are significantly reduced. The system can be configured to detect duplicate receipts or expenses that fall outside established norms.

One of the key lessons I learned during this transition was that an ERP system isn’t just a tool; it’s a partner in digital transformation. It forces you to look at your internal processes with a critical eye. We had to clarify our expense policies, streamline our approval hierarchies, and educate our staff on the new system. It wasn’t just about flipping a switch. There was an initial learning curve, of course. Some employees, particularly those less comfortable with technology, needed extra hand-holding. But the benefits quickly became apparent to everyone.

I remember one sales executive, a seasoned veteran who was initially skeptical of anything "newfangled," telling me how much he appreciated being able to submit his expenses from the airport lounge, rather than having to save everything for when he got back to the office. "It’s one less thing to worry about," he’d said, "and I get my money back faster." That simple statement encapsulated the profound impact of this change.

For businesses looking to implement or upgrade their ERP staff expense tracking, my advice would be to focus on a few key areas:

- Define Your Policies Clearly: Before you even look at software, get your expense policies in order. What are your limits? What categories do you need? Who approves what? The clearer your rules, the more effectively the system can be configured.

- Choose the Right System: Not all ERPs are created equal. Look for a system that is intuitive for end-users (your staff), offers robust mobile capabilities, integrates well with your existing accounting and payroll systems, and provides strong reporting features. Cloud-based ERPs often offer more flexibility and scalability.

- Prioritize User Training: Don’t just roll it out and expect everyone to figure it out. Provide clear training, offer support, and create easily accessible guides. Show them how it benefits them, not just the company.

- Start Small, Scale Up: If a full ERP implementation feels daunting, many systems allow you to start with just the expense management module and then expand to other areas like procurement or project management later.

- Embrace Change Management: Change can be hard. Communicate the "why" behind the new system. Highlight the benefits. Address concerns openly. Having champions within different departments can also help drive adoption.

- Leverage Reporting and Analytics: Don’t just use the system for processing. Dive into the data it provides. Analyze spending patterns, identify areas for cost reduction, and use the insights to make better financial decisions. This real-time reporting is one of the most powerful aspects of modern ERP.