I remember the early days, back when our little venture first started dipping its toes into international waters. It felt exciting, a true sign of growth. We’d just landed our first big client in Germany, then another in Japan, and suddenly, our straightforward accounting system felt like trying to steer a rowboat through a hurricane. Every invoice, every payment, every balance sheet entry was a puzzle wrapped in a riddle, all because of one thing: different currencies.

We were a small but ambitious team. My finance manager, Sarah, a brilliant mind with a knack for numbers, would spend hours, sometimes days, wrestling with spreadsheets. I’d walk by her desk and see a multitude of tabs open, each one a different exchange rate calculator, historical data, current rates, forward rates. It was a dizzying dance of conversion, recalculation, and cross-referencing. If a payment came in from our German client in Euros, she’d have to manually convert it to our reporting currency, US Dollars, using the exchange rate of that specific day. Then, when she paid a supplier in Yen, the whole process repeated.

The problem wasn’t just the sheer manual effort; it was the cracks that inevitably appeared. A tiny slip of a finger, an outdated exchange rate, a miscalculation in a formula – any of these could throw our entire financial picture out of whack. We’d get to the end of the quarter, and the figures just wouldn’t add up. We’d spend precious days backtracking, trying to find the discrepancy, often discovering it was a simple human error amplified by the complexity of multi-currency transactions.

Imagine trying to understand your company’s true financial health when your cash balance in one currency is constantly fluctuating against your home currency, and you’re not seeing that change reflected immediately. We’d make decisions based on what we thought our cash position was, only to find out later that a significant shift in exchange rates had eaten into our perceived profits, or unexpectedly boosted them. This wasn’t just inconvenient; it was risky. We needed a clearer, more reliable way to manage our international money matters. We needed something that understood that a Euro wasn’t always just 1.10 US Dollars, and that today’s rate might be different from tomorrow’s, or even yesterday’s.

That’s when we started looking seriously at Enterprise Resource Planning, or ERP, systems. I’d heard about them, of course, but always thought they were for the "big guys," the multinational corporations with thousands of employees. But as our global footprint expanded, even modestly, it became clear that this wasn’t a luxury; it was a necessity. And specifically, we needed an ERP system with robust multi-currency accounting capabilities.

The initial research was daunting. There were so many options, so many features, so much jargon. But the core idea was simple: a central brain for our business. Instead of having separate systems for sales, inventory, and accounting, an ERP would bring it all under one roof. And the multi-currency part? That was the golden ticket for us.

When we finally implemented our chosen ERP system, it felt like a collective sigh of relief echoed through the finance department. The change wasn’t instant, mind you. There was a learning curve, data migration, and plenty of "how do I do this now?" questions. But once we got the hang of it, the transformation was nothing short of revolutionary for our international accounting.

Let me tell you what it changed, and why it became so indispensable for managing foreign exchange accounting and global business accounting.

The Magic of Real-Time Conversion and Automated Rates

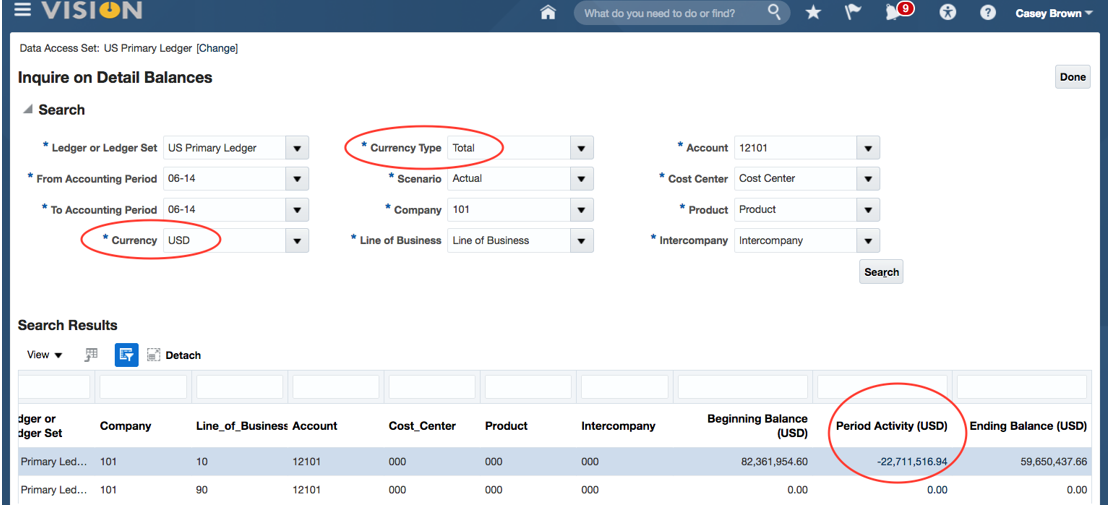

The biggest headache before was the manual conversion of every single transaction. Our ERP changed that entirely. When a sales order was placed in Euros, the system automatically recorded it in Euros and converted it to our base reporting currency (USD) using the exchange rate for that specific date. This wasn’t just a one-off conversion; the system maintained an updated database of exchange rates, often integrating with financial services to pull in real-time or daily rates.

This meant Sarah no longer had to hunt for rates. The system handled it. When an invoice was generated, it showed the amount in the customer’s currency and, behind the scenes, tracked its USD equivalent. When the payment came in, the system applied the current exchange rate, calculated any difference from the original invoice rate, and automatically recorded it. This was the beginning of understanding foreign exchange gains and losses.

Understanding Foreign Exchange Gains and Losses

Before the ERP, "foreign exchange gains and losses" felt like an abstract concept, something only big banks cared about. For us, it was a messy footnote in a spreadsheet. But with the ERP, it became a clear, tangible part of our financial reporting.

Here’s how it works: Let’s say we issue an invoice to our German client for 10,000 Euros when the exchange rate is 1 Euro = 1.10 USD. Our system records this as a receivable of 10,000 EUR and 11,000 USD. A month later, the client pays us. But now, the exchange rate has shifted to 1 Euro = 1.08 USD. When the 10,000 EUR hits our bank, the system converts it to 10,800 USD.

Immediately, the ERP flags the difference: we expected 11,000 USD, but only received 10,800 USD. That 200 USD difference is automatically recorded as a "realized foreign exchange loss." If the rate had gone up to 1.12 USD, we would have seen a "realized foreign exchange gain." This automated tracking meant we could see precisely how currency fluctuations impacted our bottom line, without any manual calculations.

But it goes a step further with "unrealized" gains and losses. At the end of a reporting period (say, month-end or quarter-end), if we still have open invoices or outstanding payments in foreign currencies, the ERP revalues them using the period-end exchange rate. If that 10,000 Euro receivable is still open, and the rate is now 1.09 USD, the system will record an "unrealized foreign exchange loss" of 100 USD (from 1.10 USD to 1.09 USD). This isn’t money we’ve lost or gained yet, but it gives us a much more accurate picture of our assets and liabilities at that moment, essential for accurate financial statements. This ability to revalue open items and track both realized and unrealized FX impacts was a game-changer for our financial transparency.

Automated Reconciliation and Bank Integration

Reconciliation used to be another nightmare. Matching bank statements in various currencies to our internal records was tedious and prone to error. Our multi-currency ERP integrated directly with our bank accounts, even those held in foreign currencies. This meant bank feeds could automatically pull in transactions, and the system would attempt to match them against our invoices and payments.

If a payment came in from Japan in Yen, the ERP would recognize the amount, convert it to USD, and try to match it to an outstanding Yen invoice. Any discrepancies were highlighted, making the reconciliation process significantly faster and more accurate. This level of automation freed up Sarah’s team to focus on analysis rather than endless data entry and cross-checking. We could see our cash position across all currencies, in real-time, consolidated into our reporting currency.

Seamless Vendor and Customer Management

Working with international vendors and customers became so much smoother. When we purchased raw materials from a Chinese supplier, we’d enter the invoice in Yuan. The ERP would track it in Yuan and its USD equivalent. When it came time to pay, the system facilitated the payment in Yuan and recorded the exact USD amount leaving our bank, automatically calculating any FX gain or loss.

Similarly, our sales team could issue quotes and invoices in the customer’s preferred currency, knowing that the accounting backend was handling all the complex conversions. This not only improved our internal efficiency but also enhanced our professional image with international partners. We weren’t fumbling with exchange rates; our system was sophisticated enough to handle it all, making transactions feel effortless for everyone involved.

Streamlined Reporting and Compliance

One of the less glamorous but incredibly important aspects of multi-currency accounting is compliance. Different countries have different reporting requirements, and international accounting standards like IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles) have specific rules for how foreign currency transactions and revaluations should be handled.

Our ERP became our compliance guardian. It ensured that all foreign currency transactions were recorded according to the correct methodologies. When it came time to generate financial statements, whether for internal review or external auditors, the system could produce reports in our base currency (USD) or even in other currencies if needed, all consolidated and accurate. This meant our balance sheets, income statements, and cash flow statements reflected the true economic reality of our global operations, significantly reducing audit risk and giving us peace of mind. No more worrying about whether we’d correctly applied the "temporal method" or the "current rate method" for foreign entity consolidation; the system handled the mechanics based on our configuration.

Beyond the Numbers: The Strategic Advantages

The benefits extended far beyond just accurate bookkeeping. With real-time data on our multi-currency transactions, we gained invaluable insights. We could see which currencies exposed us to the most risk, allowing us to consider hedging strategies if needed. We could analyze profitability by region or by customer, regardless of the transaction currency, because everything was consolidated into a single, understandable view.

This level of financial transparency empowered us to make better, faster business decisions. Should we expand into another market? What’s the true cost of that imported component? How much revenue are we really generating from our overseas sales? The answers were no longer buried under layers of manual calculations; they were readily available within our ERP. It moved us from reactive firefighting to proactive strategic planning.

Choosing the Right System and the Implementation Journey