You know, in my years navigating the wild and wonderful world of Enterprise Resource Planning, I’ve seen a lot of things. I’ve seen projects soar to incredible heights, transforming businesses in ways no one thought possible. And, sadly, I’ve also seen projects crash and burn, leaving behind a trail of exhausted teams, frustrated executives, and, most painfully, empty bank accounts. The difference, more often than not, boils down to one critical element: how well we manage the money. That’s right, we’re talking about ERP project cost control, and if you’ve ever wondered how to keep these massive undertakings from turning into financial black holes, pull up a chair. I’ve got some stories to tell and a few hard-won lessons to share.

It’s a bit like building a dream house, isn’t it? You start with an exciting vision, a blueprint, and a budget. But then, the architect suggests a skylight, the contractor finds a "surprise" behind a wall, and suddenly, your dream house is costing a lot more than you initially imagined. ERP projects are exactly like that, but on a grander, more complex scale. They involve intricate software, highly paid consultants, a whole lot of data, and the most unpredictable element of all: people.

My first big dive into an ERP implementation was a baptism by fire. We were a mid-sized manufacturing company, growing fast, and our old systems were creaking under the strain. The promise of a shiny new ERP was intoxicating – streamlined operations, better data, happier customers. The initial budget, presented by a charismatic vendor, seemed perfectly reasonable. We signed on the dotted line, brimming with optimism. What followed was a masterclass in how quickly costs can spiral out of control if you’re not constantly vigilant. We ended up way over budget, though thankfully, we eventually got it across the finish line. That experience taught me more about cost control than any textbook ever could. It etched into my mind the absolute necessity of treating every penny of an ERP project as if it were your own.

So, why are ERP projects so notorious for going over budget? Well, it’s not just malice or incompetence, though those can certainly play a role. It’s primarily due to their inherent complexity and scope. An ERP isn’t just one piece of software; it’s an integrated suite designed to touch almost every part of your business – finance, HR, supply chain, manufacturing, sales, you name it. Changing one part often has ripple effects across many others. This interconnectedness means that what seems like a small tweak can have significant cost implications.

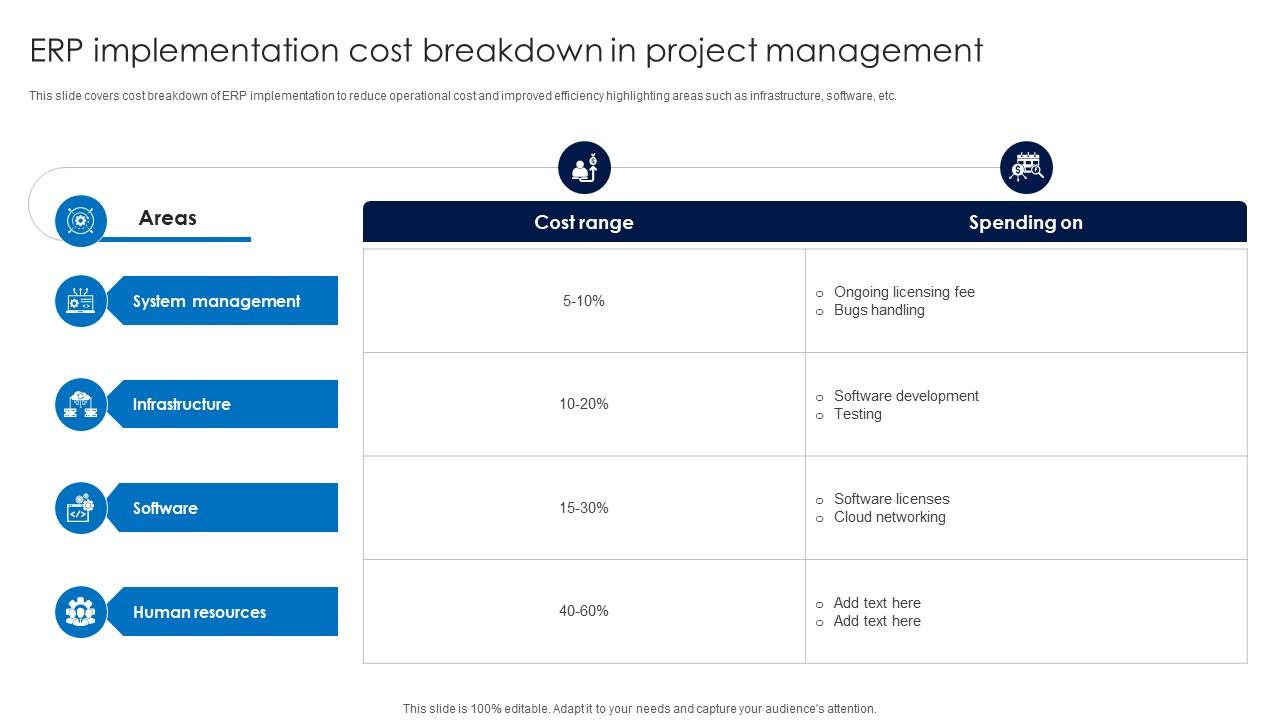

Let’s break down where the money usually goes. First, there’s the software itself. You’ve got your license fees, which can be a hefty upfront cost or ongoing subscriptions if you’re going the cloud route. Then come the implementation services. This is often the biggest slice of the pie. You’re hiring experts – consultants, system integrators, project managers – who help you configure the software, customize it to your specific needs, migrate your old data, and train your team. These folks are brilliant, but their time is precious and expensive. Next, hardware and infrastructure if you’re hosting it on-premise, or the ongoing costs of cloud hosting. Don’t forget data migration, which sounds simple but can be a nightmare of cleaning, transforming, and moving mountains of information. Then there’s training – ensuring everyone from the shop floor to the executive suite knows how to use the new system. And finally, the often-forgotten heroes: change management and contingency. Change management is about helping people adapt, which is crucial but rarely budgeted adequately. Contingency? That’s your emergency fund for when things inevitably don’t go exactly as planned.

My biggest takeaway from that first project was that cost control doesn’t start when things go wrong; it starts at the very beginning, with meticulous planning and a crystal-clear vision. It’s about building a solid foundation before you even break ground.

Phase 1: Laying the Financial Foundation – The Art of Smart Planning

This is where you make or break your budget. Think of it as mapping out your journey before you leave the driveway.

-

Defining the Scope – What You Really Need: This is probably the single most critical step. I’ve seen countless projects balloon in cost because the initial scope was vague, or, worse, became a "wish list" for every department. Everyone gets excited about the new system and starts adding features they’ve always wanted. This phenomenon is lovingly called "scope creep," and it’s a budget killer. My team and I learned to be ruthless here. We’d sit down with stakeholders, not just asking "What do you want?" but "What problem are you trying to solve?" and "Is this absolutely essential for our core business processes right now?" We’d categorize features into "must-haves," "nice-to-haves," and "future considerations." Sticking to the "must-haves" for the initial implementation saves a fortune. It’s about being disciplined and saying "no" politely but firmly to non-essential additions until the core system is stable and live.

-

Realistic Budgeting – The Educated Guess: Forget those simple "industry average" percentages. They’re a starting point, sure, but your company is unique. We developed a habit of doing a thorough bottom-up budget, itemizing every single cost component we could think of. We’d also look at historical data from similar projects (if we had any) and get multiple quotes from vendors. And here’s the kicker: always include a healthy contingency fund. I’m talking 15-20% of the total budget, especially for larger, more complex projects. Why? Because something will go wrong, something will take longer, and something will cost more than you expected. That contingency isn’t just for emergencies; it’s for peace of mind and allows you to absorb those inevitable bumps without derailing the entire project or having to beg for more funds mid-way.

-

Vendor Selection and Negotiation – More Than Just a Price Tag: Choosing your ERP vendor and implementation partner is like choosing a life partner for your business. It’s a huge decision. Don’t just go with the cheapest option. My advice? Get multiple proposals, and don’t be afraid to push back. Look beyond the sticker price. What’s included? What’s not included? Are there hidden fees? What are their support costs after go-live? Negotiate hard on consulting rates, project timelines, and payment schedules. A well-structured contract with clear deliverables and penalties for delays can save you untold amounts of money and heartache down the line. Remember, they want your business, so make them work for it.

-

Choosing the Right ERP Fit – Gold Plating vs. Good Enough: Do you need a Rolls-Royce when a perfectly good, reliable sedan will do? Many companies fall into the trap of over-specifying their ERP, opting for a Tier 1 system with every bell and whistle when a more agile, mid-market solution would be a better, more cost-effective fit. Evaluate your needs honestly. Are you a global enterprise with complex supply chains, or a growing business looking for better financial visibility? Cloud-based ERPs often have lower upfront costs and predictable subscription models, which can be great for budgeting, while on-premise solutions give you more control but demand significant IT investment. The wrong choice here can lead to years of unnecessary expense or, conversely, a system that can’t keep up.

-

Strong Project Management – Your Budget’s Guardian: You absolutely need a dedicated, experienced project manager (PM). This isn’t a part-time job you can tack onto someone’s existing responsibilities. A good PM is your budget’s best friend. They’re the ones tracking everything, holding people accountable, escalating issues, and, crucially, managing changes to the scope. Without strong project leadership, even the best plans can unravel.

Phase 2: The Execution Dance – Monitoring, Adapting, and Staying on Track

Once the planning is done and the project is underway, it’s all about constant vigilance. This is where your budget guardian, the PM, truly earns their stripes.