I remember the days when managing payments felt like a chaotic orchestra playing out of tune, each instrument doing its own thing, never quite in sync. Before we truly embraced the power of an integrated ERP payment processing system, our business was a flurry of manual tasks, scattered spreadsheets, and the constant dread of reconciliation day. It was a nightmare, frankly. Let me tell you a story, my story, about how we transformed that cacophony into a harmonious, efficient symphony, all thanks to understanding and implementing what might sound like a very technical term, but is, in reality, a profoundly human solution.

Picture this: sales orders coming in from one system, invoices being generated in another, and then the actual payments trickling in through various channels – bank transfers, credit cards, sometimes even checks. Each payment needed to be manually matched to an invoice, then manually entered into our accounting software, and then, if we were lucky, eventually reconciled with our bank statements. It was a process riddled with errors, delays, and an incredible amount of wasted human potential. My finance team, bless their hearts, spent hours, days even, chasing down discrepancies, trying to figure out which payment belonged to which customer and for what product. It wasn’t just inefficient; it was demoralizing. People were tired, stressed, and always felt like they were one step behind. This wasn’t just a small startup; we were a growing business, and these manual hurdles were actively stifling our potential.

Our turning point came when we started seriously looking at Enterprise Resource Planning, or ERP, systems. At first, the idea seemed overwhelming. ERP sounded like something only mega-corporations used, a beast of a system that would be too complex and expensive for us. But as we delved deeper, we realized that an ERP is essentially a central nervous system for your business. It connects all the disparate functions – sales, inventory, purchasing, finance, human resources – into one unified platform. The promise was alluring: imagine if all these pieces of information could talk to each other seamlessly. That’s where the magic truly began, especially when we started to understand the critical role of payment processing within this grand scheme.

You see, payment processing isn’t just about accepting money; it’s about the entire lifecycle of a transaction, from the moment a customer decides to buy, to the point where that money is safely in your bank account and correctly recorded in your books. In our old world, this lifecycle was fragmented. With an ERP, the goal was to make it a single, flowing river. We realized that simply having an ERP wasn’t enough; we needed it to be deeply integrated with how we handled incoming and outgoing payments. This wasn’t just an add-on; it was an essential artery for our financial health.

The first major benefit we noticed, the one that brought audible sighs of relief from the finance department, was the sheer automation it offered. Before, when a customer paid via credit card, someone had to manually go into our accounting system, find the corresponding invoice, mark it as paid, and then categorize the payment. Now, with the ERP payment processing system, once a payment came through our integrated payment gateway, it automatically updated the relevant invoice in the ERP. The system knew which customer it was, which order it related to, and marked it as paid, all without human intervention. This wasn’t just faster; it eliminated a huge source of human error. No more mistyping amounts, no more assigning payments to the wrong customer. It was like having a tireless, perfectly accurate digital assistant.

Think about cash flow. Every business lives and breathes by its cash flow. In the old days, because of those manual delays, we often had a fuzzy picture of our true financial standing. We knew money was coming in, but exactly how much, from whom, and when it would clear, was always a bit of a mystery until someone spent hours crunching numbers. With the ERP and its integrated payment processing, our cash flow became transparent, almost in real-time. As payments were processed and recorded instantly, we could see our current financial position with incredible clarity. This meant better decision-making. We could forecast more accurately, plan investments, and respond to challenges much faster. It was like finally having a clear map instead of constantly navigating in the fog.

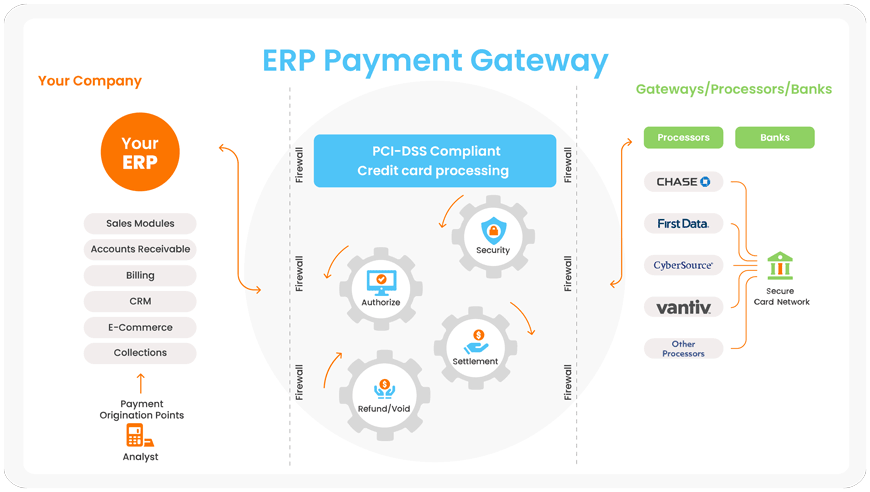

Security was another huge concern that the integrated system helped us address. Handling sensitive customer payment information, especially credit card details, is a massive responsibility. Before, we had bits of information in different places, relying on various isolated security measures. When you integrate payment processing directly into your ERP, you centralize this security. Our chosen ERP solution adhered to stringent industry standards like PCI DSS compliance, meaning the way it handled, stored, and transmitted cardholder data was inherently more secure. This wasn’t just about protecting our customers; it was about protecting our business from potential breaches and the devastating fallout that comes with them. It gave us, and our customers, a much greater sense of trust and peace of mind.

And then there was reconciliation. Oh, reconciliation! This used to be the bane of our existence. Trying to match bank statements with our internal records was like solving a giant, messy puzzle with half the pieces missing. Bank fees, different payment dates, failed transactions – it all added to the confusion. With the ERP payment processing, a significant portion of this nightmare simply vanished. Because the system automatically recorded payments and often linked directly with our bank accounts, it could pre-match many transactions. What used to take days of painstaking work now took hours, sometimes even minutes, to simply review and confirm. My finance team was able to shift their focus from grunt work to more strategic tasks, like analyzing financial trends and identifying opportunities for growth, which felt like a true liberation.

The benefits weren’t just internal. Our customers felt the difference too. Imagine a customer making a payment online. In our old system, there was always a delay before that payment was reflected on their account or before their order was truly marked as paid and shipped. Sometimes, they’d get a follow-up email about an unpaid invoice even after they’d paid, simply because our internal systems hadn’t caught up. It was frustrating for them and reflected poorly on us. With the integrated ERP, the moment a payment was confirmed, their account was updated. This meant faster order processing, fewer confusing communications, and a smoother overall customer experience. It built confidence and loyalty, something every business strives for.

Choosing the right ERP and, more specifically, the right payment processing integration wasn’t a walk in the park, I won’t lie. It required a deep dive into our existing processes, an honest assessment of our pain points, and a clear vision for the future. We looked for a system that could handle multiple payment methods – credit cards, debit cards, ACH transfers, even international payments in various currencies. This was crucial for our expanding global reach. We needed robust reporting capabilities, so we could slice and dice our financial data in any way imaginable, gaining insights into sales performance, customer payment habits, and outstanding receivables. We also made sure the system had strong fraud detection mechanisms, because in today’s digital world, you can never be too careful.

Implementation was another big hurdle, but one that was absolutely worth overcoming. It wasn’t just about installing software; it was about rethinking our workflows, training our team, and migrating years of historical data. There were bumps along the road, moments of frustration, and the inevitable learning curve. But throughout it all, we kept our eyes on the prize: a more efficient, secure, and transparent financial operation. We worked closely with our ERP vendor and payment gateway provider, ensuring a tight, seamless integration that met our specific business needs. Customization played a role here, as every business has its unique quirks, and our ERP allowed us to tailor the payment processing flow to fit our exact requirements without compromising the core functionality.

One of the most profound impacts was on our decision-making. Before, business decisions were often based on incomplete or outdated financial data. It was like trying to steer a ship in a storm with a compass that only worked sporadically. With the ERP payment processing system providing real-time, accurate financial information, our leadership team could make informed decisions quickly. Should we invest in new inventory? Are we on track to hit our quarterly revenue targets? Which marketing campaigns are generating the most profitable sales? The answers were no longer buried under piles of paperwork or delayed by manual processing; they were at our fingertips, presented in clear, actionable reports.

Consider the human element again. My team, the very people who used to dread reconciliation and chase payments, are now more engaged, more productive, and frankly, happier. They spend less time on repetitive, mundane tasks and more time on analysis, problem-solving, and contributing to the strategic growth of the company. This shift in focus has been incredibly empowering. It’s not just about saving money or increasing efficiency; it’s about valuing human intelligence and directing it towards tasks that truly require human creativity and insight. That, to me, is one of the most compelling arguments for an integrated ERP payment processing system.

So, if you’re a business owner or a financial manager still wrestling with fragmented payment processes, still suffering through manual reconciliation, or still feeling that constant underlying anxiety about the security of your transactions, I urge you to look into an ERP payment processing system. It’s not just about technology; it’s about transforming your business. It’s about turning that chaotic orchestra into a seamless symphony, where every instrument plays its part perfectly, contributing to a harmonious and successful performance. It’s a journey, yes, but one that leads to clarity, efficiency, security, and ultimately, peace of mind. And in the complex world of business, what could be more valuable than that?