I remember a time, not so long ago, when our warehouse felt less like a well-oiled machine and more like a treasure hunt gone wrong. Boxes piled high, dusty corners hiding forgotten stock, and the constant, nagging question: "Do we even have that?" It was a chaotic symphony of misplaced items, urgent phone calls, and the gut-wrenching feeling of telling a customer, "Sorry, we’re out," when you knew it had to be somewhere. We were essentially running our business blindfolded, relying on intuition, scribbled notes, and the occasional frantic physical count that usually left everyone more confused than enlightened.

Our inventory was the beating heart of our operation, but we treated it like a mystery novel. We knew we needed to get a grip, but the sheer scale of it, the countless SKUs, the constant ebb and flow of goods – it felt insurmountable. We’d try manual spreadsheets, but they were always outdated the moment they were printed. We’d try spot checks, but they only ever showed us a tiny slice of a much bigger, much messier pie. The stress was palpable, the money wasted on excess stock or lost sales from stockouts was staggering, and frankly, it was just plain exhausting.

Then came the day we decided to embrace an ERP system. For those who might be new to this world, ERP stands for Enterprise Resource Planning. Think of it as a central nervous system for your entire business, connecting everything from sales and purchasing to finance and, crucially, inventory. At first, it felt like a monumental task, like trying to teach an old dog new tricks, or rather, trying to teach an entire company a whole new way of working. Data entry, process changes, training sessions – it was a lot. But what truly transformed our understanding and operations wasn’t just the system itself, but the incredible insights it started spitting out: the ERP Inventory Performance Reports.

These weren’t just fancy spreadsheets; they were stories, rich with data, telling us exactly what was happening behind the scenes. It was like suddenly being given a pair of x-ray glasses for our entire warehouse, allowing us to see not just the surface, but the underlying structure, the flow, the blockages, and the opportunities. For a beginner, it might sound intimidating, all those numbers and charts. But let me tell you, once you understand what each report is trying to tell you, it becomes your most powerful ally.

Let me walk you through some of the reports that became our daily bread, the ones that pulled us out of the inventory wilderness and onto a path of clarity and efficiency.

First up, and probably the most fundamental, were the Stock Level Reports. Before ERP, "stock level" was often a guess. "We probably have enough," or "I think we’re running low." With the ERP, we could see, in real-time, exactly how much of every single item we had. Not just in the main warehouse, but in transit, at our satellite locations, even items reserved for specific customer orders. This was revolutionary. I remember the first time I pulled up a report showing the current stock of our top 100 products. It wasn’t just a number; it was a snapshot of our immediate capacity. We could instantly identify items that were critically low and needed reordering, or conversely, items we had way too much of, tying up valuable capital and space. This report was our early warning system, helping us prevent those dreaded "out of stock" moments that used to plague us.

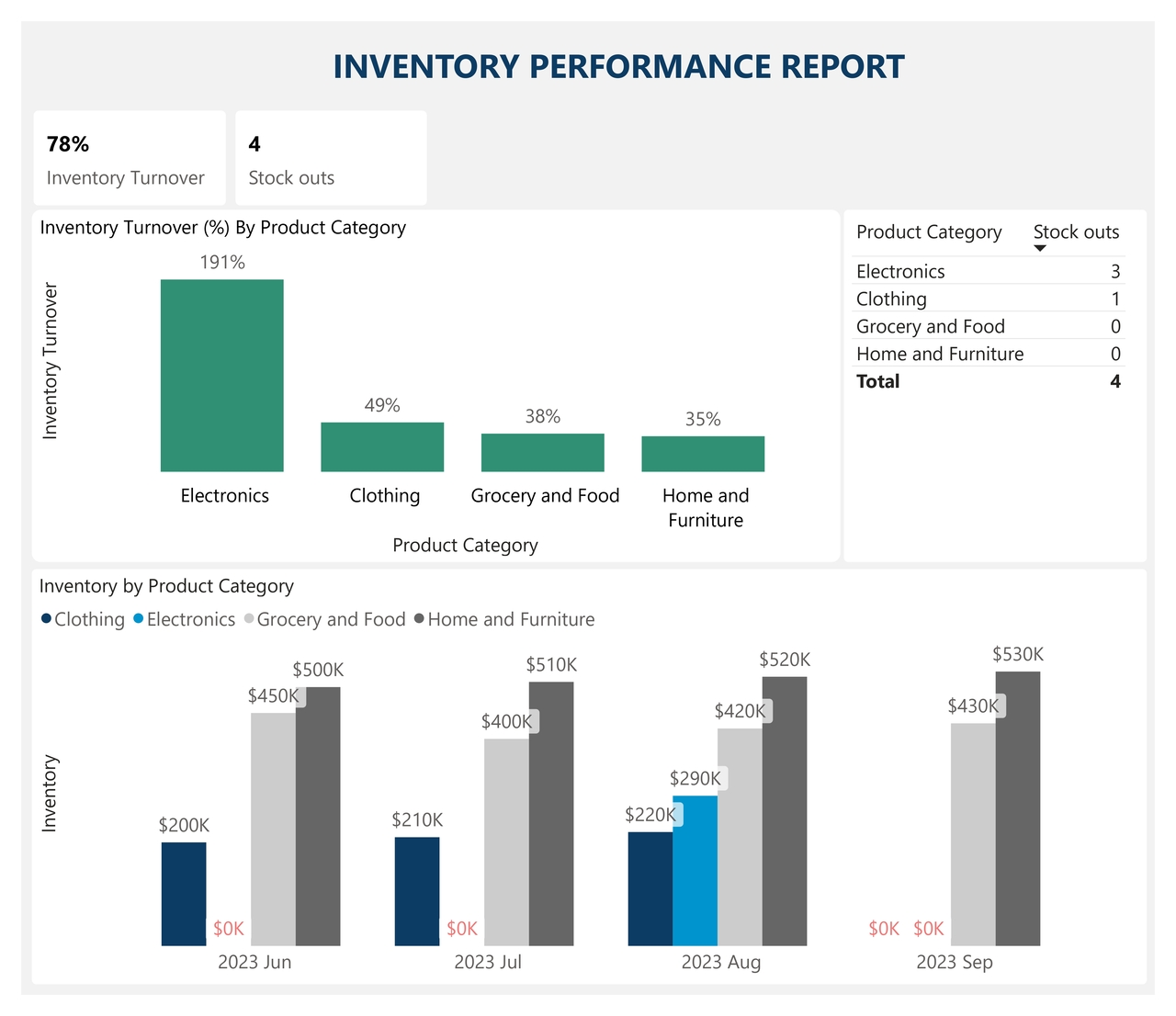

Then there was the Inventory Turnover Report. Oh, this one was an eye-opener! It essentially told us how many times we sold and replaced our entire inventory within a given period. A high turnover often meant we were selling products quickly and efficiently, which is generally good. A low turnover, however, screamed, "Warning! Dead stock ahead!" It showed us items that were just sitting there, gathering dust, slowly depreciating in value, and costing us money in storage. Before this report, we’d just feel like some items weren’t moving. Now, we had concrete data. We could see product X had turned over only twice in a year, while product Y turned over twelve times. This insight allowed us to make informed decisions: maybe it was time to run a promotion on product X, or perhaps even discontinue it, freeing up capital and space for faster-moving goods. It transformed our purchasing strategy, moving us from reactive buying to proactive, data-driven procurement.

Another report that quickly became indispensable was the Demand Forecasting Report. This one felt like peering into a semi-reliable crystal ball. By analyzing historical sales data, seasonal trends, and even external factors (which the ERP could sometimes integrate), the system would project future demand. Now, it wasn’t perfect, no forecast ever is, but it was infinitely better than our old method of just guessing based on last month’s sales. With these reports, we could anticipate peaks and troughs in demand. If we knew a certain product historically sold like hotcakes in Q4, we could proactively increase our stock levels well in advance, avoiding last-minute rushes and premium shipping costs. It helped us smooth out our supply chain, ensuring we had the right products at the right time, minimizing both stockouts and excessive carrying costs.

The Cost of Carrying Inventory Report was a bit of a tough pill to swallow, but absolutely essential. It laid bare the true cost of holding onto our stock. This wasn’t just the purchase price; it included storage costs (warehouse rent, utilities, insurance), depreciation, obsolescence, and even the opportunity cost of having capital tied up in goods instead of invested elsewhere. Seeing these numbers in black and white was a powerful motivator to optimize our inventory levels. It showed us that having too much stock wasn’t just an inconvenience; it was a significant drain on our profitability. We realized that every day an item sat on a shelf, it was essentially costing us money, even if it wasn’t physically deteriorating.

Then there were reports focused on efficiency and accuracy, like the Inventory Accuracy Report and Shrinkage Reports. Inventory accuracy, simply put, is how closely your physical count matches what your system says you have. A low accuracy rate means chaos. Shrinkage refers to the loss of inventory due to theft, damage, obsolescence, or administrative errors. Before ERP, we just knew things "went missing." With these reports, we could track discrepancies, identify problematic areas, and even pinpoint specific items or locations where losses were higher. It helped us tighten our security, refine our counting processes, and reduce waste. We started seeing patterns, like certain products being consistently miscounted, leading us to investigate our receiving or picking processes for those specific items.

Beyond the core inventory reports, our ERP also offered fantastic insights through related reports, such as Supplier Performance Reports and Order Fulfillment Reports. While not strictly about our inventory levels, they profoundly impacted how we managed our stock. Supplier performance reports showed us which suppliers were consistently late, delivered incomplete orders, or had quality issues. This data allowed us to negotiate better terms, switch to more reliable suppliers, or build in buffer stock for less dependable ones. Order fulfillment reports, on the other hand, gave us a clear picture of how quickly and accurately we were getting products out the door to our customers. Were there bottlenecks in picking, packing, or shipping? These reports illuminated those areas, helping us streamline our operations and improve customer satisfaction.

The beauty of these ERP Inventory Performance Reports wasn’t just in the data itself, but in how it empowered us to make intelligent, proactive decisions. We moved from a reactive, crisis-management mode to a strategic, forward-thinking approach.

For instance, armed with the Inventory Turnover Report, our purchasing manager could now confidently approach suppliers and negotiate better deals for high-turnover items, knowing exactly how much we’d need and how quickly we’d move it. The sales team, looking at the Demand Forecasting Reports, could adjust their sales targets or promotional strategies based on anticipated stock availability, avoiding the frustration of selling something they didn’t have. Our warehouse team, with real-time Stock Level Reports, could optimize storage locations, placing fast-moving items in easily accessible spots, reducing picking times and improving overall efficiency.

The transformation was tangible. We saw a significant reduction in stockouts, which meant fewer disappointed customers and more consistent sales. We drastically cut down on excess inventory, freeing up capital that we could then reinvest into growth initiatives or other parts of the business. Our warehouse became less of a chaotic mess and more of an organized hub, with clear processes and a team that felt empowered by accurate information. The endless arguments about "who ordered too much" or "where did that go" slowly faded, replaced by data-driven discussions about optimization and improvement.

Now, if you’re a beginner reading this, you might be thinking, "This all sounds great, but how do I even start?" My advice is simple: don’t try to master every single report at once. Start with the basics. Understand your current stock levels. Figure out what’s moving and what’s not. Look for patterns. The ERP system is a tool, a powerful one, but it still needs a human touch to interpret and act on its insights.

Here’s a little secret: the reports are only as good as the data you put in. So, accuracy in data entry, proper scanning procedures, and consistent processes are paramount. If your data is messy, your reports will be misleading. It’s like baking a cake – if you put in the wrong ingredients, no matter how good your oven, the cake won’t turn out right.

Another crucial point is to customize your reports. Every business is unique, and what’s critical for one might be less so for another. A good ERP system allows you to tailor reports to your specific needs, focusing on the Key Performance Indicators (KPIs) that matter most to your operation. Don’t be afraid to experiment, to ask your ERP provider or internal IT team for help in setting up reports that answer your most pressing questions.

Also, don’t just run the reports and file them away. Use them! Discuss them with your team. Make them a regular part of your operational meetings. When everyone understands the story the data is telling, and how their actions impact those numbers, you build a culture of accountability and continuous improvement. We started having weekly "inventory huddles" where we’d review the key reports, celebrate successes, and brainstorm solutions for challenges revealed by the data. It brought a whole new level of collaboration to our team.

In essence, ERP Inventory Performance Reports aren’t just about numbers; they’re about understanding your business deeply, making smarter decisions, and ultimately, building a more resilient and profitable operation. They turn guesswork into knowledge, chaos into order, and frustration into efficiency. If you’re still stuck in the "treasure hunt" phase of inventory management, take my word for it: investing in an ERP system and truly leveraging its reporting capabilities will be one of the best decisions you ever make. It was for us, and the quiet confidence that comes from knowing exactly what’s happening in your warehouse is, quite frankly, priceless. It wasn’t just a system; it was a silent revolution that brought clarity and control to the heart of our business.